In the rapidly evolving landscape of digital marketing, the healthcare industry has witnessed a surge in the demand for affiliate marketing, with aggregators playing a central role. Over the past decade, insurers, brokers, and senior care companies have increasingly turned to aggregators, paying a percentage of the product sold or a flat rate for a lead or referral. The rise of digital marketing has propelled these aggregators, who leverage sophisticated online comparison platforms, digital marketing expertise, and superior online customer experiences.

The insurance aggregator market in North America stands at an impressive $7 billion, according to data from Allied Market Research, showcasing the substantial influence of aggregators in the healthcare industry.

Lead Generation Aggregators vs. Product Comparison Aggregators

Understanding the nuances between lead generation and product comparison aggregators is essential for companies navigating the affiliate marketing landscape.

Lead Generation Aggregators

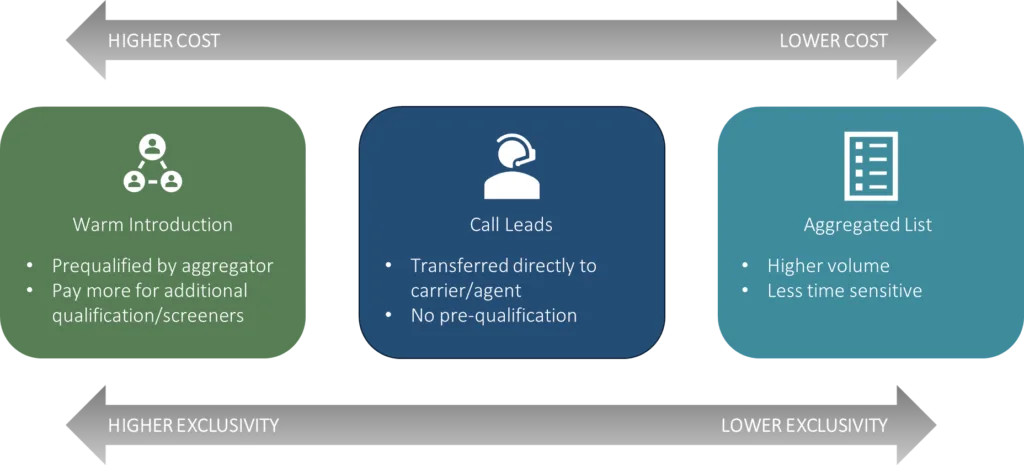

Lead generation aggregators employ their own no-brand-name marketing strategies to create demand, capture consumer interest, and subsequently sell leads to end-users such as insurers, brokers, or senior care companies. This can take various forms, including customer lists, leads, and introductions.

Exclusivity: In addition to determining the depth of lead generation, executives must weigh the importance of exclusivity in their partnerships with aggregators. Many aggregators sell the same leads to multiple partners unless the end user pays a premium for exclusive leads or referrals.

Figure 1: Higher and lower cost and exclusivity in partnerships with aggregators

Product Comparison Aggregators

Product comparison aggregators sell directly to consumers by collecting branded digital marketing from competing companies on a proprietary online platform. This enables consumers to comparison shop in an unbiased manner. These aggregators often partner with trusted retail, pharmacy, and wellness brands to create co-branded marketing, offering consumers a convenient one-stop-shopping experience.

Aligning Marketing Goals to the Right Affiliate Marketing Options

Leveraging affiliates for acquisition can be a lucrative endeavor if approached thoughtfully and executed with care. A clear understanding of the quality of member affiliate marketing can be crucial. Oftentimes, there are tradeoffs between lower acquisition costs and potentially lower customer lifetime value.

Leveraging Aggregators for Acquisition

Acquiring members via affiliates is more than a “fire and forget” exercise. To maximize effectiveness, carriers can take concrete steps:

- Capture Comparison Shoppers: Identify and capture consumers who are likely to comparison shop, ensuring a strong online presence on well-known comparison-shopping websites.

- Increase Awareness for a Halo Effect: Elevate product and brand awareness to create a halo effect. Even when shopping around, consumers want to feel confident in their choices.

- Broaden Reach: Aggregators, with their marketing efforts, have additional reach. Target audience segments that companies may not have otherwise captured, particularly in areas or demographics with lower penetration.

Optimizing Member Retention

Retaining members acquired via aggregators presents unique challenges. To enhance retention, marketing executives should focus on four key factors: good data, early engagement, strong aggregator partnerships, and holistic analyses of aggregator-captured members.

- Good Data: Tracking member cohorts based on sales channels and applying predictive indices for likelihood to switch is essential for identifying high-risk members.

- Early Engagement: Members captured indirectly need early engagement strategies to foster a connection. Promote downloading the app, selecting a primary care provider, and completing the member profile.

- Strong Aggregator Partnerships: Collaborative communication plans between aggregators and insurers can improve retention among converted consumers, avoiding confusion and reinforcing the plan selection.

- Holistic Analyses: Regular analyses of aggregator-captured members are necessary to assess goal achievement and optimize aggregator utilization for future strategies.

Navigating the Future of Healthcare Marketing

In conclusion, aggregators are an integral part of the health insurance landscape, offering companies the choice to actively capitalize on their strengths or passively receive sales. A scientific view of indirect channel tradeoffs, leveraging data to determine the future role of aggregators in a marketing and sales channel strategy, is key. To delve deeper into the intricacies of sales disruptions and recalibrated selling motions prompted by the pandemic, we invite you to download our whitepaper for invaluable insights.

Download our whitepaper, “Navigating 5 Fundamental Shifts in Healthcare Marketing and Sales Channels”

For a more in-depth exploration of the the role of aggregators, and four other disruptions, download our whitepaper.