Today, 39% of health insurance consumers purchase online, and this percentage is on the rise. However, it’s important to note that 61% of consumers still rely on face-to-face or telephonic agents for their insurance needs.1 Therefore, insurers must navigate the right balance between self-service-led experiences and agent-led experiences effectively.

3 Key Steps to Balancing Self-Service and Agent-Led Models

Fortunately, finding the right balance between self-service and agent-led can be undertaken systematically:

- Align Channels with How Customers Buy

- Adjust for Channel Economics

- Design Routes-to-Market Resources

Step One: Align Channels with How Customers Buy

Embrace the notion that channels don’t choose customers; customers choose channels. It’s a foundational principle for any go-to-market strategy. Regular buyer research is crucial for understanding why buyers prefer one channel over another.

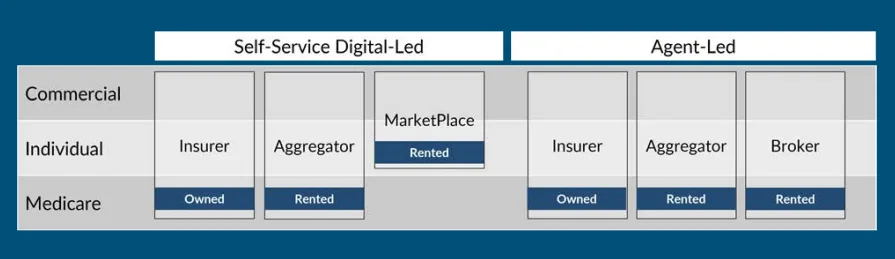

A Self-Service Digital-Led Channel is defined as customers independently navigating digital platforms for transactions. When customers engage with agents—either virtually or in person—for assistance, guidance, or to finalize complex transactions, that is considered an Agent-Led Channel. As you can see in Figure 1 below, both Channels include owned (direct channels owned by an insurer) and rented channels (such as brokers, aggregators, etc.).

Keeping an ongoing 360-degree view of how customers buy is critical to deeply understanding why buyers within each line of insurance are choosing one channel over another. These varying customer intentions and motivations by channel will provide insight into current and potential future buyer segments, and ultimately, the path to designing a more relevant CX.

Figure 1: Health insurance channel landscape

Step Two: Adjust for Channel Economics

Channel economics are the efficiencies (or lack thereof) to acquire new customers. Focus on three key performance indicators (KPIs) to adjust appropriately:

- Selling expense-to-revenue ratio (E/R) – Measuring E/R by channel ensures that cost-of-sale economics are affordable in the context of overall business profitability targets.

- Customer Acquisition Cost (CAC) – Understanding the cost to acquire a member provides insight into the upfront channel cost, which is essential to forecasting and projections.

- Member Lifetime Value (LTV) – While some channels may be more expensive in the short-term, they may yield high lifetime value customers for greater long-term results.

Step Three: Design Routes-to-Market Resources

Conduct thorough resource planning for each channel, covering infrastructure, training, and marketing. Ensure clear documentation of resources allocated to each channel, including expenses, and review this at least quarterly to align with channel performance and buyer feedback.

- Update Infrastructure: For Self-Service Digital-Led channels, prioritize a best-in-class online experience. For Agent-Led channels, secure or renew partnerships with brokers and aggregators.

- Ongoing Training: Train technologists to troubleshoot issues via Self-Service Digital-Led channels and train agents how to use sales platforms and understand the nuances of plan benefits in local areas.

- Marketing Support: Deploy demand capture campaigns for Self-Service Digital-Led channels to drive awareness and traffic. For Agent-led channels, deploy awareness marketing to drive consumer awareness and consideration, as well as provide agents with audience-specific materials to aid in the sales experience.

Planning for Tomorrow’s NextGen Distribution Model

Health insurers are facing a dynamic landscape where the balance between self-service and agent-led channels is pivotal. Adapting to evolving customer expectations and optimizing business outcomes requires a strategic approach. The three steps detailed in this blog should be addressed in the context of long-term strategy. Utilizing a “clean sheet” technique, it’s important to envision a distribution model five years ahead to foster innovative test-and-learn opportunities.

Adapting to digital and omnichannel experiences is essential for success. Doing so while adjusting for channel economics, and investing in effective routes-to-markets, insurers can not only thrive in the present but actively prepare for the uncertainties of tomorrow.

Download our whitepaper, “Navigating 5 Fundamental Shifts in Healthcare Marketing and Sales Channels”

For a more in-depth exploration of the changing balance between self-service and agent-led channels, and four other disruptions, download our whitepaper.

1 Derek Andersen. “41 Insurance Marketing Statistics You Need to Know in 2024,” Invoca, October 3, 2023; https://www.invoca.com/blog/ insurance-marketing-statistics