Working with go-to-market (GTM) organizations is always an engaging experience. And while there’s rarely a dull moment, there is also the sense that GTM teams are at the mercy of micro- and macro-economic factors out of their control. For the most part, this is an accurate statement, but also let it be a call-to-action to find better means to deliver sustainable, predictable value to the organization. A call to get sharper—to look at go-to-market with the lens of science and economics, and build a more resilient approach to driving growth and profit.

No one can profess to know the future (definitively), so humans, and GTM leaders specifically, must understand, interpret and react to situations with data and information we have at hand. Gone are the days (if there ever were those days) of set-it-and-forget-it strategy. GTM leaders are tasked with constantly reacting to changes, disruption and uncertainty. All while being asked to grow faster, leaner and more predictably.

Growth Theatre

It’s no wonder that a lot of GTM leaders have a bias for action—which they generally should—but while the instinct is to act, this comes with the risk of misreading signals and making bad decisions. And here’s this thing: companies are generally not suffering from lack of action—they’re drowning in it. The problem is that a lot of these actions amount to nothing more than growth theatre.

Launch something new, reorg coverage, double headcount, start a partner channel. The market isn’t waiting, so the thinking goes—why should we? While performances have their place on stage, screen and politics, GTM leaders have a responsibility to their organization and shareholders to ground their actions in durable economic models.

Everyone’s moving, but few are moving in the right direction. The problem isn’t action, it’s strategy. In times of volatility, model-less growth isn’t only less effective, it’s more expensive in terms of hard costs and opportunity costs. Smart decisions don’t take more time, but they do take more effort.

Most of that effort comes back to the issue of alignment around a hypothesis, validating assumptions, testing actions and then being able to course correct without panic. This scientific approach, in my opinion, is the difference between flailing and scaling. This is where go-to-market economics comes in—not as a function or tool, but as a way of approaching GTM alternatives and decision-making.

An Urgent Reality

The urgency for a more durable approach to growth comes not only from external market, customer and economic factors but as the mandate to leaders who occupy GTM roles. Data from Gartner shows that 71% of CMOs are under pressure to deliver measurable ROI within six months of tenure. There’s no time for a website refresh here. At the same time, only 27% of GTM leaders report high confidence in the economic and financial efficiency of their GTM efforts. And it’s not just Marketing, across functions, the gap between performance pressure and confidence is widening. Sales is optimizing for quota attainment while Marketing is optimizing for leads. And Finance is optimizing for efficiency and runway.

Everyone is working, acting, but no one is pulling in the same direction. According to Forrester, only 14% of B2B organizations say marketing and sales share a common definition of success. And 62% of GTM leaders say that internal misalignment is their single biggest barrier to growth. What’s missing isn’t effort or talent. It’s coherence.

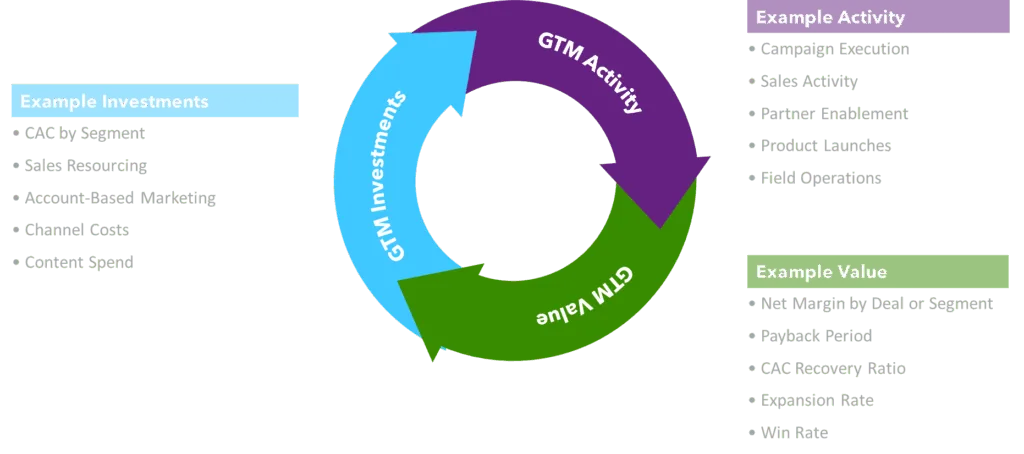

Go-to-market economics isn’t a new dashboard or planning framework—it’s a shared lens. A model that connects strategic intent with operational investment and measurable return. It turns fuzzy ambition into accountable execution.

Start with Tradeoffs

I like to think of a GTM organization as an organic organism—where dependencies and benefits affect different systems independently AND as a whole. Shifting focus to components grounded in data and facts gives leaders a stronger basis to optimize efficiency and drive growth. Lifetime value (LTV), customer acquisition costs (CAC), payback timelines, ROI and cost-to-serve are fundamental tools to prioritize and de-risk decisions for GTM leaders to scale.

The benefits are well-documented. Boston Consulting Group found that companies that use LTV:CAC modeling are more than twice as likely to beat their revenue targets. While Bain reports that fewer than 40% of companies model cost-to-serve by channel or segment! McKinsey research shows that high-performing teams revisit economic assumptions quarterly (if not monthly) because they expect the market to change and their models need to flex.

In our work, we see six economic capabilities emerge repeatedly in high-performing GTM organizations:

- Clarity on Tradeoffs: With an economic lens, every investment becomes a strategic decision where teams understand where dollars create the most value, enabling smarter resource allocation and more intentional growth

- Focus on Return, Not Just Results: Evaluating performance through ROI—not just activity and outcomes—helps teams prioritize efficiency and helps growth become scalable and sustainable, not flashy

- Confidence in Action: A shared model reduces noise and misalignment and teams act with purpose, knowing decisions are grounded in common logic rather than guesswork or internal politics

- Predictability Over Time: With an underlying model, GTM strategies become more resilient and adaptive, plans hold together through disruption because they’re designed with feedback loops and real-world variability in mind

- Objective Prioritization: A shared economic framework helps teams focus on what truly drives impact, bringing transparency to prioritization, making it easier to align around high-leverage initiatives—and let go of the rest

- Resilience to Change: When conditions shift, well-modeled strategies evolve, economics-based planning gives organizations the flexibility to adapt with intention, adjusting course while maintaining strategic integrity

Practical application of these tools can lead to more predictable patterns for growth. Instead of reacting to shifting conditions or internal noise, teams align around a shared view of value. Pipeline quality improves because targeting is more precise. Sales and Marketing collaborate on segment priorities using a common dataset. Headcount decisions are tied to ramp velocity and ROI, not just gut feel. The marketing mix stabilizes around proven drivers of performance. And dashboards—from Finance to Field—tell a consistent, trusted story.

According to Bain, nearly half of GTM strategies are now “reactively updated”—a signal that many organizations are moving quickly to respond to shifting conditions. This is sorta good. It reflects the pressure teams face in an environment where customer acquisition costs have risen over 60% in B2B SaaS over the past five years. The opportunity now is to move from reactive to adaptive, building the modeling capabilities that allow GTM teams to adjust in real time, make smarter tradeoffs, and stay ahead of market dynamics.

Where to Start?

The answer isn’t more tools. It’s better thinking. A unifying logic that ties GTM investment to growth outcomes, not activity. One that supports both urgency and durability.

- Build a Shared Model: Create a unified understanding of how growth happens—linking investments to outcomes across Marketing, Sales, Product, and Finance—it doesn’t need to be perfect, it needs to be shared

- Focus on ROI, Not Activity: Shift the conversation from volume to value, whether it’s campaigns, headcount, or programs—measure what matters, and let data, not instinct, drive prioritization

- Institutionalize Feedback Loops: Make learning part of the operating rhythm, model assumptions, test hypotheses, and adjust in real time—not just at QBRs or annual planning

At Marketbridge, we help companies build science (and economics) into GTM function at both a strategic and operating level. We use tools and principles grounded in science to help our clients drive growth and long-term value, as well as optimize operations and financial returns. Not with a reorg. Not with another planning cycle. But with grounded, practical models that help you decide where to invest, when to pivot, and how to grow without guessing.

If your GTM strategy could use that kind of clarity, we’d love to talk.

Additional references:

- HubSpot: 2024 Sales Trends Report: https://offers.hubspot.com/sales-trends-report

- OpenView: 2023 SaaS Benchmarks Report: https://openviewpartners.com/2023-saas-benchmarks-report/

- PitchBook: Q4 2023 PitchBook-NVCA Venture Monitor: https://pitchbook.com/news/reports/q4-2023-pitchbook-nvca-venture-monitor