Today the health insurance industry is as crowded as it’s ever been, making the race to the top a steep climb. Incumbents are expanding plans, new entrants are bringing innovative new business models, and let’s not forget the lead aggregators angling for the attention of the same consumer group as every individual health insurer.

What magnifies this dynamic is the local nature of health insurance markets. Plans are designed and distributed within ZIP Code ranges. As a result, most insurers have a focus on market-level budgets, market-level membership goals, and even market-level advertising. However, conditions often vary from market to market which can make market-level planning and preparedness in this crowded environment a bit of a quagmire without a clear assessment.

Market Assessment for Health Insurance Leaders

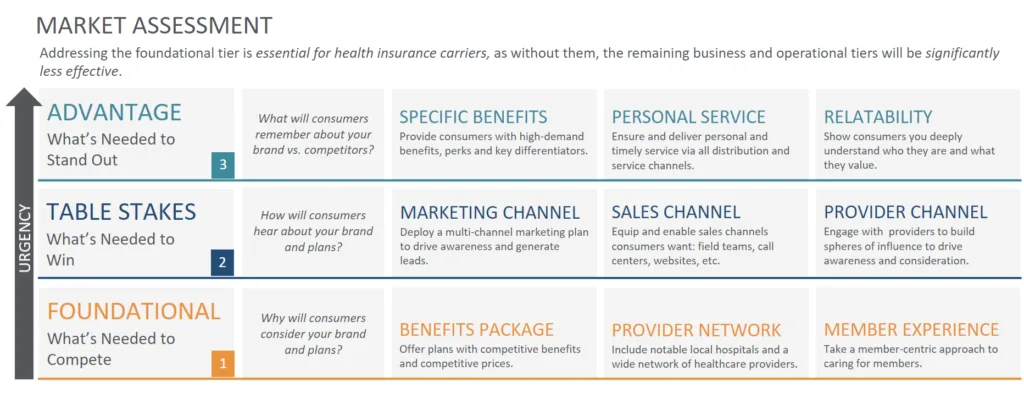

After working with some of the nation’s largest health insurance companies, we’ve found there are nine imperatives that when jointly implemented are the building blocks for market success. We’ve organized these nine imperatives into three tiers:

Addressing the Foundational tier first is essential, as without doing so, the remaining tiers will be significantly less effective.

For anyone in the insurance industry, these imperatives will be familiar. The organization of the imperatives in this assessment was developed by our Marketbridge team when asked to diagnose the root cause of why specific markets for a particular insurer were underperforming. After countless discovery interviews and performance analysis across marketing and sales, we learned these nine imperatives—when activated collectively and effectively—were the key to achieving membership goals at the market level.

Not surprisingly, during our initial analysis for the insurer, it was common to find gaps across the nine imperatives. It was also common to see a disjointed focus on where to invest the most time, resources, and budget given the context of those gaps. This assessment served as a tool to quickly convey how to view all nine imperatives, where to start to address gaps, and in what priority order.

1) Foundational Tier—Why will consumers consider your brand and plans?

As you’ll see foundational imperatives are the highest priority as they are what’s needed to compete in the market. These imperatives answer the question, “Why will consumers consider your brand and plans?”

- Benefits Package: Offer plans with competitive benefits and competitive prices.

- Provider Network: Include notable local hospitals and a wide network of healthcare providers.

- Member Experience: Take a member-centric approach to caring for members.

Benefits Package/Provider Network

Research has shown the cost of benefits and lack of access to providers are reasons why consumers consider buying or switching plans, so it’s no surprise to see those among the first two imperatives Benefits Package and Provider Network.

Member Experience

The third imperative, Member Experience, is linked to keeping existing customers, as any marketer knows the cost of acquiring a new customer is higher than retaining one. Of course, avoiding an exodus of members also helps bolster membership goals. This is something a handful of Medicare aggregators and carriers struggled with this past AEP as they lost members, resulting in significant drops in their company stock prices.

One other note on this imperative is the emphasis on being member-centric. Customer experience in a commoditized industry like insurance can be a powerful differentiator. Unfortunately, 60% of insurance executives agree that their organization is lacking in CX strategy (Forrester). So, a word of caution; beware the urge to ignore Member Experience as a foundational imperative. Its placement as a priority in this assessment is significant.

2) Table Stakes Tier—How will consumers hear about your brand and plans?

Table Stakes imperatives are what’s needed to win in the market. These imperatives answer the question, “How will consumers hear about your brand and plans?” and consist of the core Marketing, Sales, and Provider channels.

- Marketing Channel: Deploy a multi-channel marketing plan to drive awareness and generate inbound leads.

- Sales Channel: Equip and enable sales channels consumers want (field teams, call centers, websites, etc.).

- Provider Channel: Engage with providers to build spheres of influence to drive awareness and consideration.

Marketing Channel

When it comes to Marketing, consumer shopping behaviors are shifting. We’re seeing more consumers shopping and purchasing online; either across the full purchase journey or navigating across online and offline channels throughout the journey. While that’s not news to health insurance marketers, it can be a challenge when it comes to giving consumers an omnichannel, frictionless experience. Too many carriers are still working with siloed media teams focused on a limited section of the experience. They are also working with disparate technology systems—some old, some new—but none seamlessly integrated.

Another challenge within the Marketing Channel is determining the media mix. As the marketplace has become increasingly crowded, marketing cost-pers have increased. And with budget allocations often tight, marketing teams must spend each dollar as efficiently as possible. In fact, Gartner has predicted that this is the year profitability will overtake customer experience (CX) as a top strategic priority. Unfortunately, the answer to “what’s really working and what’s not” is not simple or easy, but there are solutions that can help. See our whitepaper, “Measuring Marketing’s Effectiveness.”

Sales Channel

Now, once a consumer is ready to purchase a health plan there’s a natural segue to the Sales Channel imperative. Over the years, the health insurance industry has seen significant investment in building direct-to-consumer online purchase paths. While some consumers are taking advantage, most are using digital channels to compare plans and better educate themselves, but often still choosing to speak with a licensed agent when it comes time to purchase. Therefore, equipping and enabling agents to conduct a best-in-class buying experience is crucial; from the plan information, they share with consumers to the platforms they use for enrollment.

Of course, there are many types of agents, from telesales to field with carrier-exclusive contracts to multi-carrier contracts which introduce unique dynamics such as compliance and incentives that may impact how you implement across the Sales Channel.

Provider Channel

The last Table Stakes imperative is the Provider Channel. The critical role of providers in the healthcare value chain positions them as key influencers and partners in local communities. Admittedly, the relationship between provider and insurer can be a complex one. Providers want to remain carrier-neutral but desire to help build their patient population and appreciate the advertising and on-site event support carriers can offer. Bottom line: Insurers who have support from key providers are often winners within their market.

3) Advantage Tier—What will consumers remember about your brand/plans vs. competitors?

Advantage imperatives are what’s needed to stand out in the market. These imperatives answer the question, “What will consumers remember about your brand and plans vs. competitors?” Standing out when you are offering a commoditized product like health insurance isn’t easy, especially during demand capture seasons like Open Enrollment (OE). Here are the three imperatives in the Advantage Tier:

- Specific Benefits: Provide consumers with high-demand benefits, perks, and key differentiators.

- Personal Service: Ensure and deliver personal and timely service via all distribution and service channels.

- Relatability: Show consumers you deeply understand who they are and what they value.

Can you win without these three imperatives? Yes, it’s possible. That’s why these are not included in the Table Stakes section.

However, given the shifting market dynamics such as aggregators outspending insurers in advertising and insurers partnering with retailers to foster familiarity and brand preference, those companies that don’t focus on these imperatives will continue to fade into the background.

Keep in mind that this isn’t just an acquisition challenge, it is also one for retention. Customers who have a poor experience, or don’t feel connected with their insurer, will be more readily coaxed over to a hungry competitor.

Specific Benefits

Specific Benefits are a way to spotlight a particular benefit consumers want. An example may be a Healthy Foods Card, something Anthem leaned into when it announced co-branded Medicare plans with supermarket chain Kroger.

Personal Service

Personal Service is how to put the human back into the experience of shopping and utilizing health insurance. Your health is personal. Companies helping you care for your health should show they understand that. Arguing on the phone over a claim, after having been hospitalized, is an experience that will sour a consumer’s attitude. A recent LinkedIn post I saw showed a Humana Medicare Advantage member who had been recently hospitalized coming home to a “Mom’s Meals” package from the insurer. This made sure she didn’t have to worry about shopping or cooking food for the week. That’s Personal Service done well.

Relatability

Finally, the last imperative is Relatability, which means showing your consumers you deeply understand who they are and what they value. United Healthcare embraced this concept with its Dual Complete television ad that shows those eligible for Medicare and Medicaid. However, often there are Relatability gaps in markets. For example, multicultural populations may not feel represented or heard by insurers. Insurers that embrace the Relatability imperative will have the advantage of better connecting with consumers in the market—a true advantage in today’s crowded health insurance marketplace.

Achieve Your Market-Level Goals

When activated collectively and effectively, we’ve found these imperatives are the key to achieving membership goals at the market level.

Download our whitepaper, “Navigating 5 Fundamental Shifts in Healthcare Marketing and Sales Channels”

For a more in-depth exploration of how to leverage local marketing strategies effectively, along with and four other disruptions impacting go-to-market strategy, download our whitepaper.