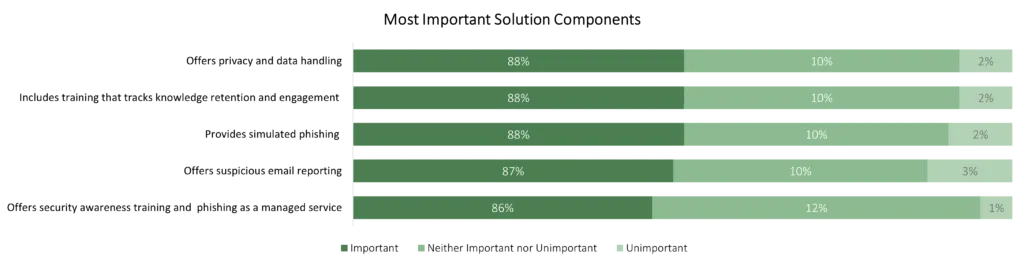

Have you ever encountered survey results showing all the respondents think everything is important or, worse, nothing is important? This survey output often arises in survey questions where respondents are asked to rate items on a scale, resulting in a chart like this:

Here, every option seems equally important, making it challenging to pinpoint what truly matters to respondents.

Now, imagine you are responsible for selecting the next best feature for your product, a decision that will trigger a multi-million-dollar investment to bring this feature to life. Or you are a CMO trying to decide what features will resonate with consumers as you break into a new market. Would you feel comfortable making a decision based on the above chart?

Probably not.

Unfortunately, this “everything is important, so nothing is” syndrome is a common quantitative research issue, especially with tools like Net Promoter Score (NPS) or Likert Scales, which struggle to measure incremental changes and extract meaningful differentiation between options.

Enter MaxDiff, a methodology designed to solve these exact problems.

What is Maximum Difference Scaling?

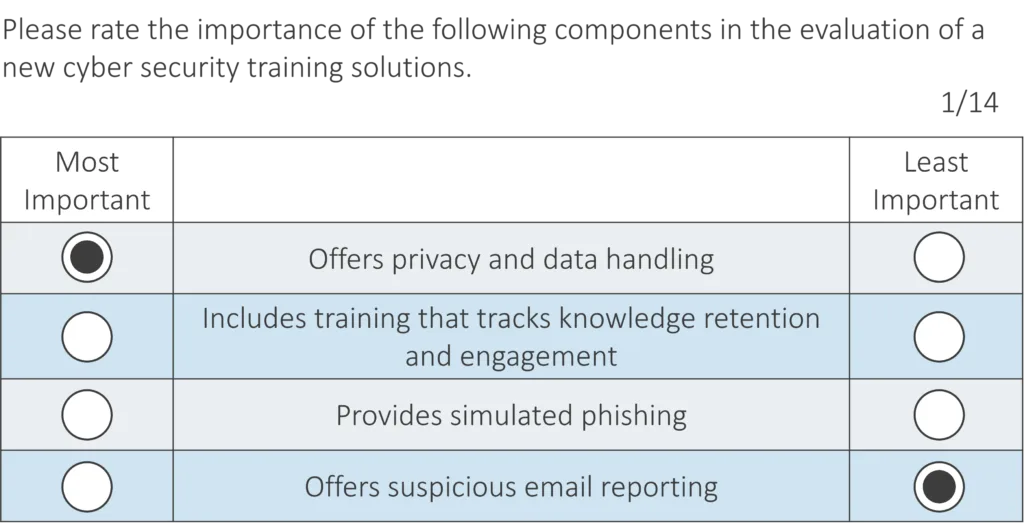

Maximum Difference Scaling, also known as MaxDiff, is an advanced choice-based tradeoff methodology used to help strategic leaders uncover better decisions about their GTM approach, products, and more. Instead of asking respondents to rate the importance of items independently, MaxDiff presents them with a set of options and forces them to make tradeoffs, indicating their most and least preferred items. The output offers crisp insights into what truly matters to respondents.

Example of what a respondent would see in a MaxDiff battery

Why Use MaxDiff?

MaxDiff can be advantageous over other research techniques for a few reasons:

- Forces Choices and Tradeoffs: By requiring respondents to choose between options, MaxDiff helps highlight preferences more sharply.

- Generates Clearer Insights: This methodology reveals gaps in importance and preferences, making it easier to identify key priorities.

- Avoids Yeah-Sayers: Respondents can’t simply agree that everything is important or not important; they must make definitive choices.

- Creates Intuitive Experience for Respondents: The format is straightforward, making it easier for participants to engage meaningfully with your survey.

- Enables More Efficient and Effective Survey Design: MaxDiff efficiently captures nuanced data without overwhelming respondents with lengthy rating scales.

When to Use MaxDiff

MaxDiff is a versatile tool that can be applied to various use cases to help marketers make more informed decisions:

- Prioritization of Features: Determine which features are most important to your customers to drive product evolutions.

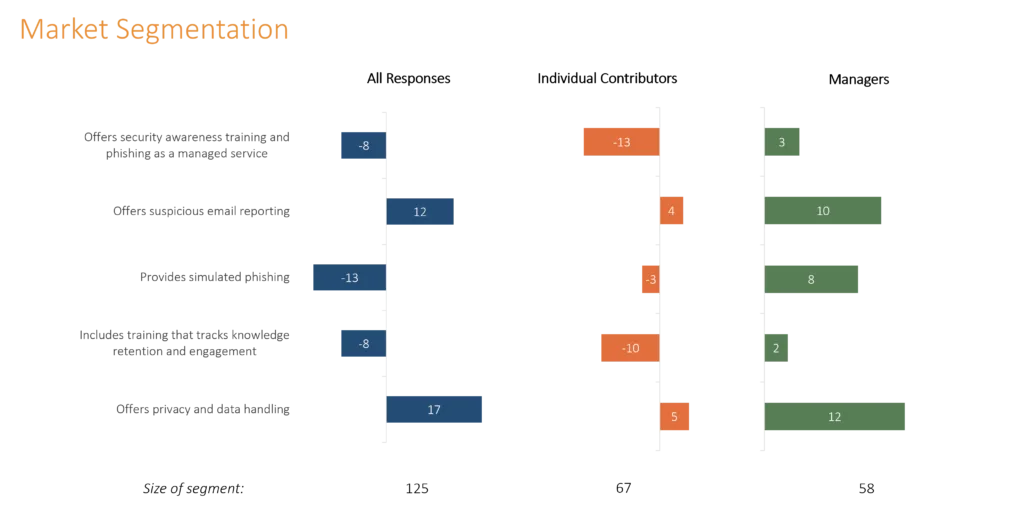

- Needs-Based Customer Segmentation: Understand and identify different customer segments based on their preferences (see below example).

- Message and Branding Testing: Find out which messages and branding efforts resonate most with your audience.

- Product Feature Testing: Identify the most and least desirable product features.

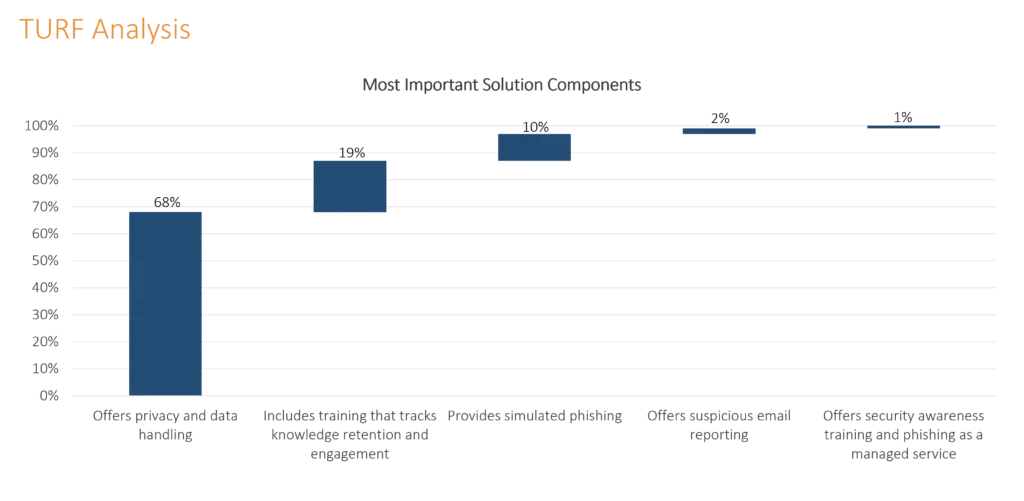

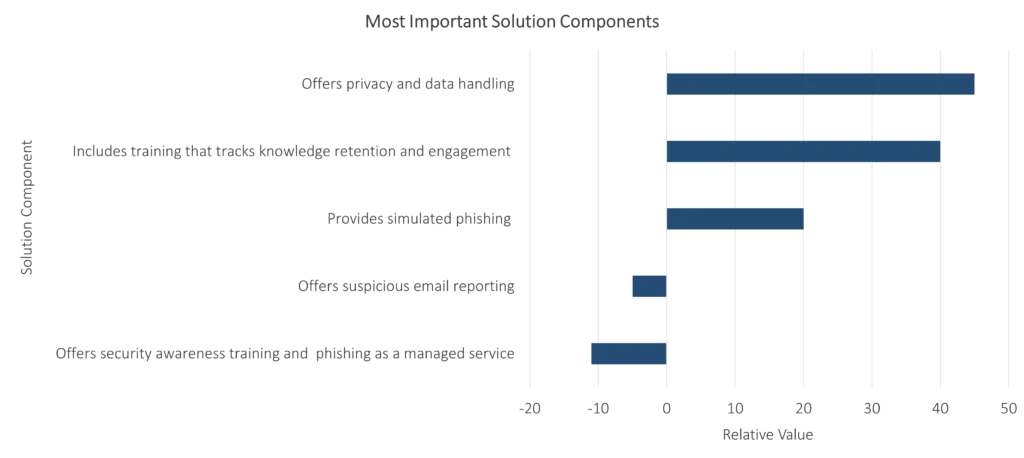

- TURF Analysis: Extend MaxDiff’s output of your product’s most important features or criteria to inform the top combination of features for your offering via a TURF (Total Unduplicated Reach and Frequency) analysis (see below example).

How to Use MaxDiff

To get the most out of MaxDiff, here’s the structured approach we follow:

- Qualitative Discovery: Begin with qualitative research to understand the broad range of needs, criteria, and options. This step ensures that your list of options is comprehensive. Note: MaxDiff won’t be able to tell you if your list of options is “good,” “bad,” or all-encompassing, so it’s crucial to identify the options in qualitative discovery to inform your next step.

- Quantitative Validation: Once you have a robust list, use the MaxDiff tool in your survey platform to validate (or disprove) each option’s importance and satisfaction levels.

- Outcome Analysis: The result is a prioritized list of needs, highlighting the most important and least satisfied criteria to address.

Example output using MaxDiff offers more differentiation between options.

MaxDiff is a powerful tool that brings clarity to the often opaque world of market research. By forcing respondents to make tradeoffs, it provides actionable insights that can help to inform product evolutions, better understand customer needs, or optimize messaging and branding. If you’re struggling with the “everything is important, so nothing is” syndrome in your surveys, it’s time to consider MaxDiff for more precise, more meaningful results.