As the health insurance landscape grows increasingly competitive, insurers must adapt to market changes to sustain revenue growth. For many individual products such as Medicare Advantage, individual health, and ancillary plans, switching rates are on the rise, reducing new plan members’ long-term value (LTV). It has become clear that relying solely on acquisition strategies is no longer viable; carriers must now focus on improving member retention rates.

Member Retention in Health Insurance

Acquisition vs. Retention Strategies

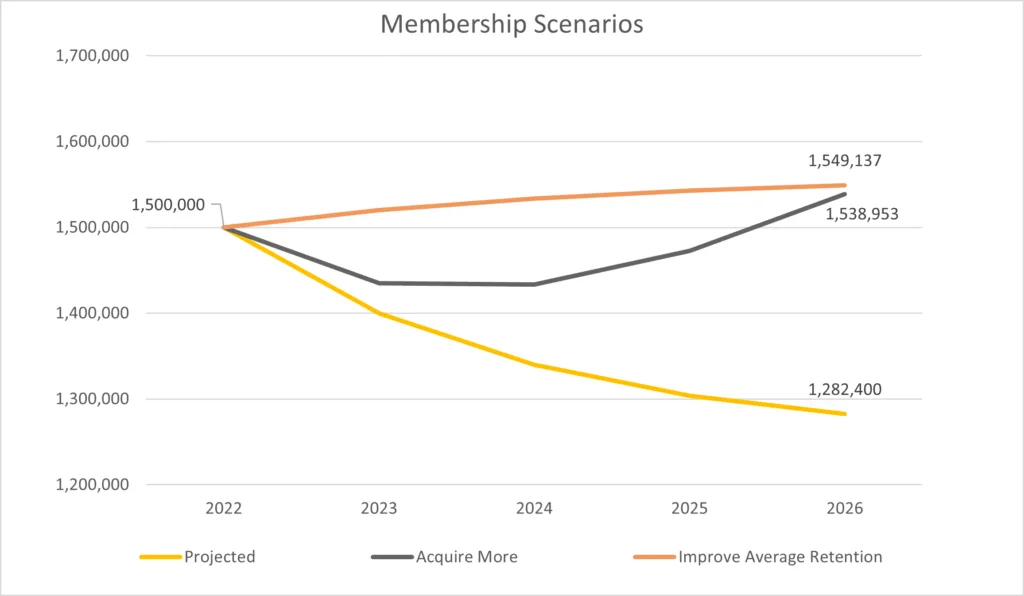

To illustrate that acquisition strategies alone are no longer viable, a simple pro forma scenario is useful. To set a baseline, let’s assume an insurance carrier has an individual product line of $400M in revenue, and let’s say that, based on recent years’ performance, membership is projected to decline by 4% over the next four years. This baseline projection now has two alternatives to achieve near-revenue neutrality: 1) spend more on acquisition to cover the retention shortfall (meaning 7% YoY acquisition growth), or 2) spend more on retention to end the rate decline (meaning improving average retention by 7 months). These three top-line scenarios are depicted in the graph below:

Assuming a member acquisition cost of $1000, the company would need to spend $375M more on acquisition to shore up the gap. With decreasing productivity in acquisition marketing given the competitive environment, this is likely a best-case scenario. Now, let’s think about if those dollars were used to drive more quality member interactions and relationship equity. Focusing on the right areas of improvement are very likely to achieve the small amount of retention improvement required. Most health insurance carriers, given market circumstances right now, are likely better off considering strategic alternatives for improving retention than simply throwing more money at acquisition.

Embracing Member Success and Engagement Models

An intriguing parallel can be drawn between this challenge and the shift to subscription and XaaS (Everything as a Service) business models that occurred in many B2B industries, particularly within the tech sector. As these industries transitioned to subscription-based models over the past decade, the importance of customer retention and long-term revenue growth became more apparent.

To respond to this shift, the tech industry developed a new sales role: “Customer Success.” In smaller markets, marketing teams have taken on the responsibility of driving customer experience to ensure revenue growth. These new roles and responsibilities within commercial teams go beyond traditional servicing, placing a strong emphasis on customer engagement and relationship development.

To thrive in this increasingly competitive market, health insurance carriers should learn from their tech counterparts and fully embrace a member success model that goes beyond traditional customer service. The first step is to identify the key moments of truth where the member experience plays a crucial role in retention. At Marketbridge, these are referred to as Zero Moments of Truth (ZMOTs). For example, the first 90 days on a plan can be a critical period for establishing engagement and building product equity with new members.

To further enhance member retention, health insurers can consider the following strategies:

- Personalized Communications: Tailor communications to individual member needs and preferences, offering valuable resources and support in managing their health and well-being.

- Proactive Health Management: Reward members who take advantage of health assessments and ongoing preventive care, demonstrating the carrier’s commitment to their health.

- Streamlined Claims Processing: Simplify the claims process with easy-to-use online tools and responsive member service to alleviate the stress associated with healthcare expenses.

- Reward Loyalty: Implement loyalty programs that offer incentives for long-term members, such as additional benefits, or access to exclusive resources.

- Enhance Digital Channels: Invest in user-friendly mobile apps and websites that provide easy access to plan information, claims status, and health resources, ensuring a seamless member experience.

While many health insurance carriers have Member Services teams and are beginning to invest heavily in tactics like the above, we still do not typically see cohesion and ownership across channels. Some carriers are looking for agents to take on more Member Services activities, however, a truly robust Member Services function can partner with agents to ease the member experience. Yet we typically see that the agent and sales apparatus significantly outpace the team staffing for Member Services. To truly move the needle, a new responsibility/function is likely necessary to be the owner of all member engagement and retention metrics. Whether this falls to a human-based servicing/member success function, a more marketing-focused revenue motion, or a hybrid, the critical point is someone and some team need to be on the hook for the holistic strategy and be empowered to execute against it.

Thriving in the Competitive Healthcare Market

To summarize, the competitive issues many health insurers are facing can be managed by learning from the strategies implemented by B2B sectors, particularly the tech industry, as they pivoted to subscription-based business models. By adopting member success and engagement models that focus on improving the member experience at key moments of truth, insurance carriers can positively impact retention rates and sustain revenue growth in an increasingly competitive market. By embracing innovation and putting members first, health insurers can ensure a prosperous future in this ever-evolving industry.