Pricing your product or service just right can feel like solving a puzzle without the picture on the box to reference. Although it can be challenging, we find pricing is one of the biggest short-term levers to drive sales performance. In fact, McKinsey reports “pricing right is the fastest and most effective way for managers to increase profits…a price rise of 1 percent, if volumes remained stable, would generate an 8 percent increase in operating profits.”

So how do you find the sweet spot for your new or existing product or service – the price point at which you can generate revenue without scaring off potential customers? That’s where survey pricing methodologies come into play. Two of the most popular direct survey-based pricing methodologies are the Gabor-Granger Model and Van Westendorp Price Sensitivity Meter (PSM), although others exist. These two methods are most helpful when looking for simple and straightforward answers about pricing. So how do these two methods work, and when should you use each one? Let’s break it down.

Gabor-Granger Model: Understanding Price Elasticity

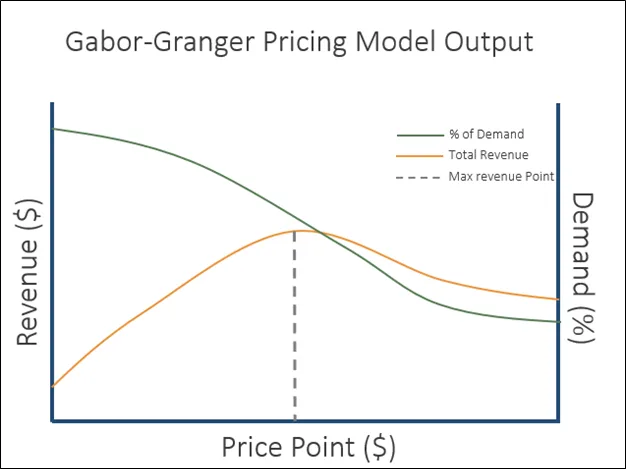

Think of the Gabor-Granger Model as a straightforward way to find the maximum price customers are willing to pay.

Here’s how the Gabor-Granger Model works:

After giving respondents the product or service description, show them a series of prices and ask how likely they are to purchase the product at each price point. If they are willing to pay that price, they are offered a higher (randomly chosen) price. If they are not willing to pay that price, they are offered a lower (randomly chosen) price. The algorithm repeats until we find the highest price each respondent is willing to pay.

Based on their answers, you can pinpoint the price that would give you the best sales while still maximizing revenue.

One of the helpful features of the Gabor-Granger model is that it helps you measure price elasticity—essentially, how sensitive customers are to price changes. For example, if you lower the price, will you see a surge in demand? Or, if you raise the price a little, will you only lose a small percentage of buyers? This method helps you predict those scenarios with confidence.

When should you use it?

The Gabor-Granger model is great when you’re trying to:

- Find revenue-optimizing price points.

- Get a clear sense of what your customers are willing to pay, especially for established products.

- Focus on just one product or service without considering competition.

What’s the catch?

While Gabor-Granger gives you clear pricing estimates, it has a couple of disadvantages:

- Since you’re suggesting the price points, it doesn’t give you insight into what consumers naturally think is a fair price.

- Because people know they’re being asked about pricing, they might understate their willingness to pay to try to get a better deal (“gaming the system”).

- The model only considers your brand or product (without factoring in the competition).

Van Westendorp: Letting Consumers Set the Range

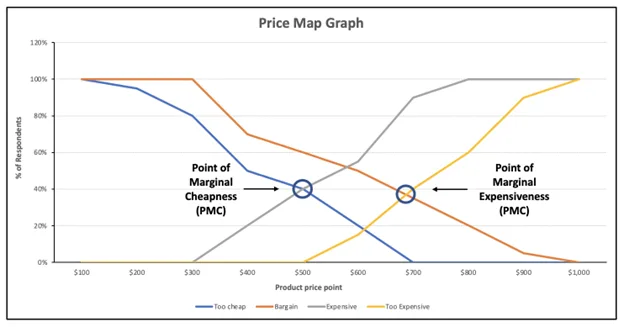

Now, let’s talk about the Van Westendorp model. Unlike Gabor-Granger, which asks respondents to react to predefined prices, Van Westendorp flips the script and lets respondents tell you what prices they think are too low, too high, and just right.

Here’s how the Van Westendorp model works:

Ask a series of questions that gauge perceptions of price. There are typically four questions, set in the context of “At what price would you consider the product to be…”:

- “Priced so low that you would feel the quality couldn’t be very good?” – to determine the “too cheap” price.

- “A bargain—a great buy for the money?” – to determine the “cheap” price.

- “Starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it?” – to determine the “expensive” price.

- “So expensive that you would not consider buying it?” – to determine the “too expensive” price.

From there, you can build a price sensitivity meter that shows the range of acceptable prices from “too cheap” to “too expensive.”

When should you use it?

The Van Westendorp method is ideal for:

- Getting exploratory results on an acceptable range of prices.

- Products or services that don’t fit neatly into an existing category.

- Gaining a deeper understanding of your target demographic and what attitudes they have about price points (and where those attitudes may impact your strategy).

The biggest advantage of Van Westendorp is that you’re getting consumer-driven pricing insights. You’re not dictating the prices (like Gabor-Granger) — consumers are, which can help you understand not only what they might pay but what they want to pay. It’s especially useful when you’re not confident in how the market will react to a specific price point.

Any drawbacks?

While Van Westendorp gives you great insights into price perception, it has a few limitations:

- It doesn’t offer a clear picture of potential revenue. Knowing that consumers think a price is fair is helpful, but it doesn’t tell you how much money you’re likely to make at that price.

- Since the pricing preferences are broad, the data can be tricky to interpret if you need concrete numbers for financial forecasting.

So, Which Method Is Best for You?

Both models have their strengths, and in some instances, they can even complement each other.

- Use the Gabor-Granger model when you’re trying to optimize revenue and you need a clear, calculated price point. This method helps when you’re dealing with products or services that already have a place in the market.

- Use Van Westendorp when you’re not sure what price the market will accept. It’s a good method for new products or niche items that don’t easily fit into existing categories.

In some cases, we recommend clients use Van Westendorp to gather a baseline of acceptable price ranges and then fine-tune those price points with the Gabor-Granger model to optimize revenue.

Final Thoughts on Survey Pricing

Pricing can make or break your business, but with the right tools, you can turn guesswork into strategy. The Gabor-Granger and Van Westendorp models give you different but equally valuable insights into how much your customers are willing to pay. Whether you’re launching something new or refining an existing product, these survey pricing methodologies can help you strike the perfect balance between affordability and profitability.