Growing up, when I heard the expression “humble pie,” I would always correct the speaker and say, “egg salad.” While super confusing to most, my parents understood perfectly—I LOVED pie and hated eggs. If there was something impossible to eat, eggs were my standing metaphor. Even now when I admit I’m wrong, I hold my nose, ignore the texture, steeling myself for some egg salad.

It was once trendy to say that “VARs are becoming MSPs.” For a while, it even looked true. Around 2015, the writing was on the wall: the traditional value-added reseller model was under pressure. Product margins were collapsing, cloud was displacing boxes, and recurring revenue was the new gold standard. To survive, the logic went, VARs would transform into managed service providers (MSPs). They would trade one-off project work for sticky, managed service contracts. They’d adopt SLAs, build helpdesks, and evolve from sales-heavy shops into operationally efficient service providers.

But in 2025, it’s time for the egg salad: most VARs never really made the jump. The ones that did are thriving—but they are the exception, not the rule.

The Seductive Simplicity of a Linear Story

This “evolution” narrative felt inevitable because it tracked with everything the market told us to value:

- Predictable recurring revenue

- Higher valuation multiples

- Greater customer lifetime value

- Alignment with cloud-first buying behaviors

Private equity bought in. Vendors retooled their partner programs. Analysts drew funnel diagrams with VARs metamorphosing into MSP butterflies. But underneath it all, the operational DNA didn’t change.

You can add a helpdesk to a VAR, but that doesn’t make you a service provider. Selling an RMM agent doesn’t mean you know how to run a co-managed IT environment. Most VARs bolted on services, but never restructured for operational scale

The Data: Divergence, Not Convergence

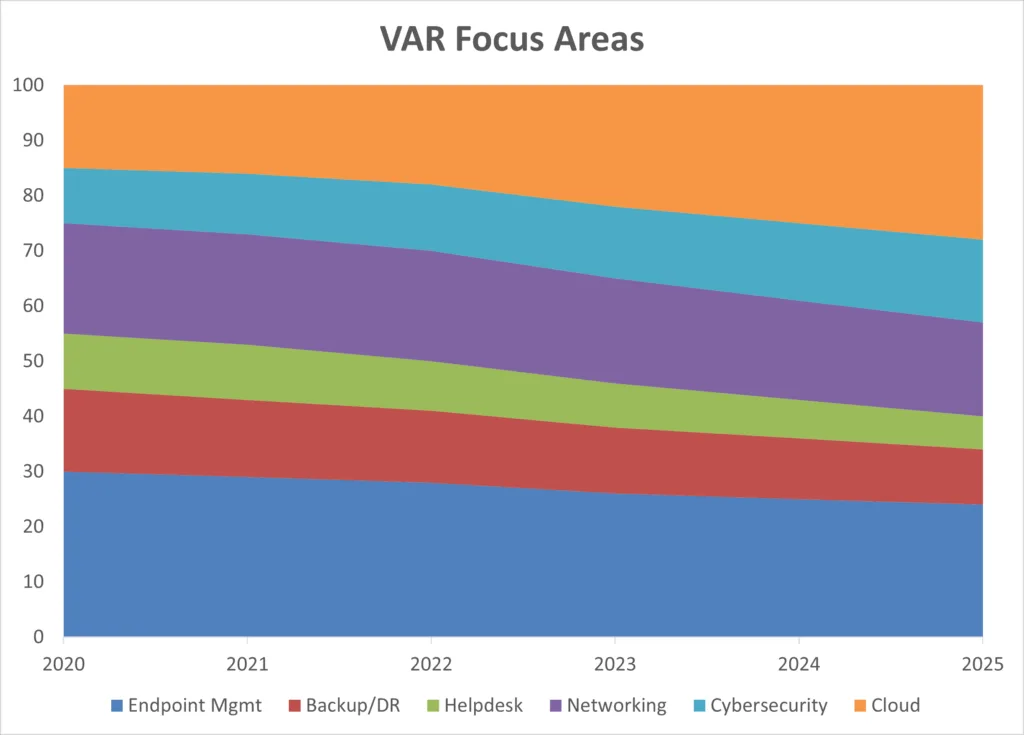

Let’s look at how MSPs and VARs actually allocate their time and revenue across service lines. A visual comparison of 2025 estimates tells the story clearly:

Chart data synthesized from publicly available reports including Canalys (MSP Landscape 2024), CompTIA (State of the Channel 2023–2025), Kaseya/Datto MSP Benchmark Reports, and IDC Partner Ecosystem Forecasts. Figures are directional estimates reflecting market share by service line and are rounded for comparative visualization.

This isn’t just a surface-level difference—it reflects a complete divergence in operating models. MSPs are anchoring themselves in scalable, automated, recurring service delivery. VARs remain largely tied to hardware, implementation, and short-term projects.

Where MSPs are optimizing for margin per ticket and time-to-resolution, VARs are still chasing margin per unit sold and quoting cycles. This graph is less a snapshot than a roadmap—the MSP economy is moving in a fundamentally different direction.

Why Most VARs Didn’t Make It

- The Culture Gap: VARs are project-based. They optimize for margin on discrete transactions. MSPs are operational entities. They think in workflows, SLAs, and margin per ticket. That shift isn’t just financial—it’s organizational. And many VARs didn’t want to make it.

- The Tech Stack Problem: MSPs build around RMM, PSA, MDM, and now AI-driven automation. VARs, meanwhile, are often stuck quoting hardware and maintaining legacy relationships with distributors. You can’t bolt managed services on top of that stack—you need a replatforming.

- The Talent Trap: Great MSPs invest in service delivery talent—L1, L2, and increasingly virtual CIO roles. VARs hire for pre-sales engineering and deal support. The skillsets are different, and so is the hiring motion. You can’t just retrain a sales org to run managed services.

- The PE Playbook Wasn’t Enough: Yes, private equity firms tried to MSP-ify their VAR portfolios. Some succeeded. But many just bundled services with no operational integration. They got a few years of EBITDA uplift, but not the long-term transition they expected.

What Actually Happened

So if VARs didn’t become MSPs, what did they become?

The answer depends on how aggressively they evolved:

- The Bold Few replatformed and built true MSP engines. These are now indistinguishable from born-in-the-cloud players.

- The Middle Majority added services but remained sales-centric. These firms are being commoditized or acquired.

- The Legacy Holdouts stuck with project work, hardware, and on-prem support. Many are now losing relevance.

Meanwhile, the MSP segment matured, specialized, and consolidated. We now see:

- Vertical MSPs with deep IP in healthcare, legal, construction, etc.

- MSSPs born from MSPs that doubled down on cybersecurity.

- Platform MSPs that run integrated, repeatable service models across hundreds of clients.

A New Playbook for Vendors

If you’re a vendor with a cloud, SaaS, or hybrid HW/SW portfolio, it’s tempting to cling to the idea that your legacy VARs will modernize into service delivery partners. But that bet isn’t aging well.

Instead, consider this:

- Segment by Operating Model, Not by History: Don’t ask, “Were they a VAR or MSP?” Ask, “Do they have the systems, people, and incentives to drive recurring service outcomes?”

- Prioritize Integration into the MSP Stack: MSPs want fewer tools, deeper integration, and automated workflows. If your solution doesn’t plug into their PSA, RMM, or ticketing platforms, you’re just noise.

- Lean Into Specialization: The fastest-growing MSPs are niche-focused. Help them go deeper: offer compliance bundles, co-branded vertical marketing, or SLAs tailored to end-client needs.

- Design Programs for Stickiness, Not Just Margin: Margin incentives are table stakes. Design for long-term revenue growth: training, automation, customer success collaboration, and shared account planning.

A 2025 Playbook for MSPs

- Productize Services: Bundle high-margin, repeatable services (e.g., MDR, compliance-as-a-service) that scale.

- Automate Everything: Use AI and ML in ticket triage, patching, threat detection.

- Standardize Stack: Fewer tools, deeper integrations—limit vendor sprawl.

- Deepen Vertical Expertise: Create proprietary playbooks for specific industries.

- Co-Manage Strategically: Partner with internal IT teams, not compete with them.

- Invest in CS + Renewal Ops: Recurring revenue doesn’t renew itself. Customer success drives MRR durability.

A 2025 Playbook for VARs

- Decide: Reinvent or Specialize: Either replatform into a true MSP or go deep into enterprise project expertise.

- Bundle + Subcontract: Don’t try to become an MSP overnight. Partner with one and build margin into bundles.

- Modernize Sales Motions: Sell lifecycle value, not just SKUs. Introduce consumption-based offerings.

- Align with Cloud & Security: Even if project-based, lead with what clients are prioritizing—zero trust, hybrid cloud.

- Offload Low-Margin Services: Get out of break/fix, generic helpdesk, and backup unless fully automated.

The idea that VARs are becoming MSPs was a useful bridge story—but it’s no longer true in most cases. Instead of hoping for convergence, it’s time to embrace the divergence. I am never going to eat egg salad, but a nice fried or scrambled egg may make the cut.