Sales organization design case study

New go-to-market sales strategy improves sales efficiency by 42%

The challenge

Can growth continue with unfair sales coverage and missed opportunities?

Despite tremendous growth in the previous year, this SaaS company had seen large variations in the performance of their sales representatives with unfair territory coverage. Strong product-led growth left many loyal customer opportunities dormant. Here’s how Marketbridge helped design a more efficient go-to-market strategy that aligned sales motions with revenue potential and customer value for growth.

The objective

Diagnose and align to accelerate growth

The client’s objective was to gain a top-to-bottom analysis of their current sales strategy and highlight key areas of focus. This analysis would then be used to provide a framework to accelerate growth and scale effectively.

Through interviews with key stakeholders, it was observed that there was a lack of knowledge on how to market and communicate to customers beyond the end user. Additionally, there was a disconnect between the different players throughout the sales process, along with the sentiment that sales-led accounts could have been performing well above their current ARR.

Key gaps were also observed in both current segmentation and coverage. A bifurcated segmentation model blurred the lines for account coverage, with 43% of accounts misaligned due to poor segmentation, and inconsistent role definitions created a lack of connection to revenue objectives and the sales cycle. With this information, our goal was to design and implement a revised go-to-market sales strategy, aligning revenue potential, customer value and sales motions to enable future growth.

The solution

Three steps to optimize roles, territories, and incentives

Step 1: Baseline assessment and strategy alignment

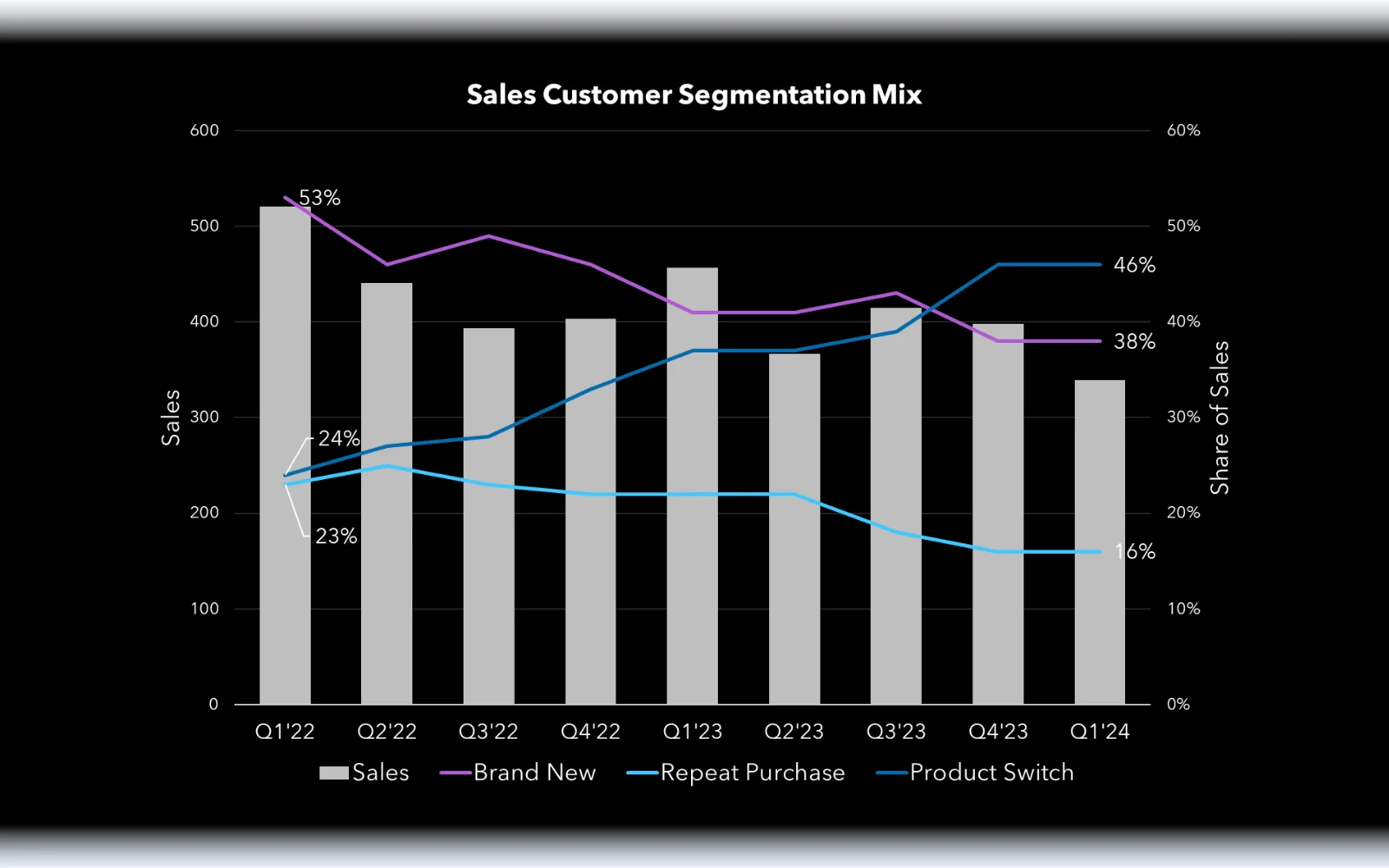

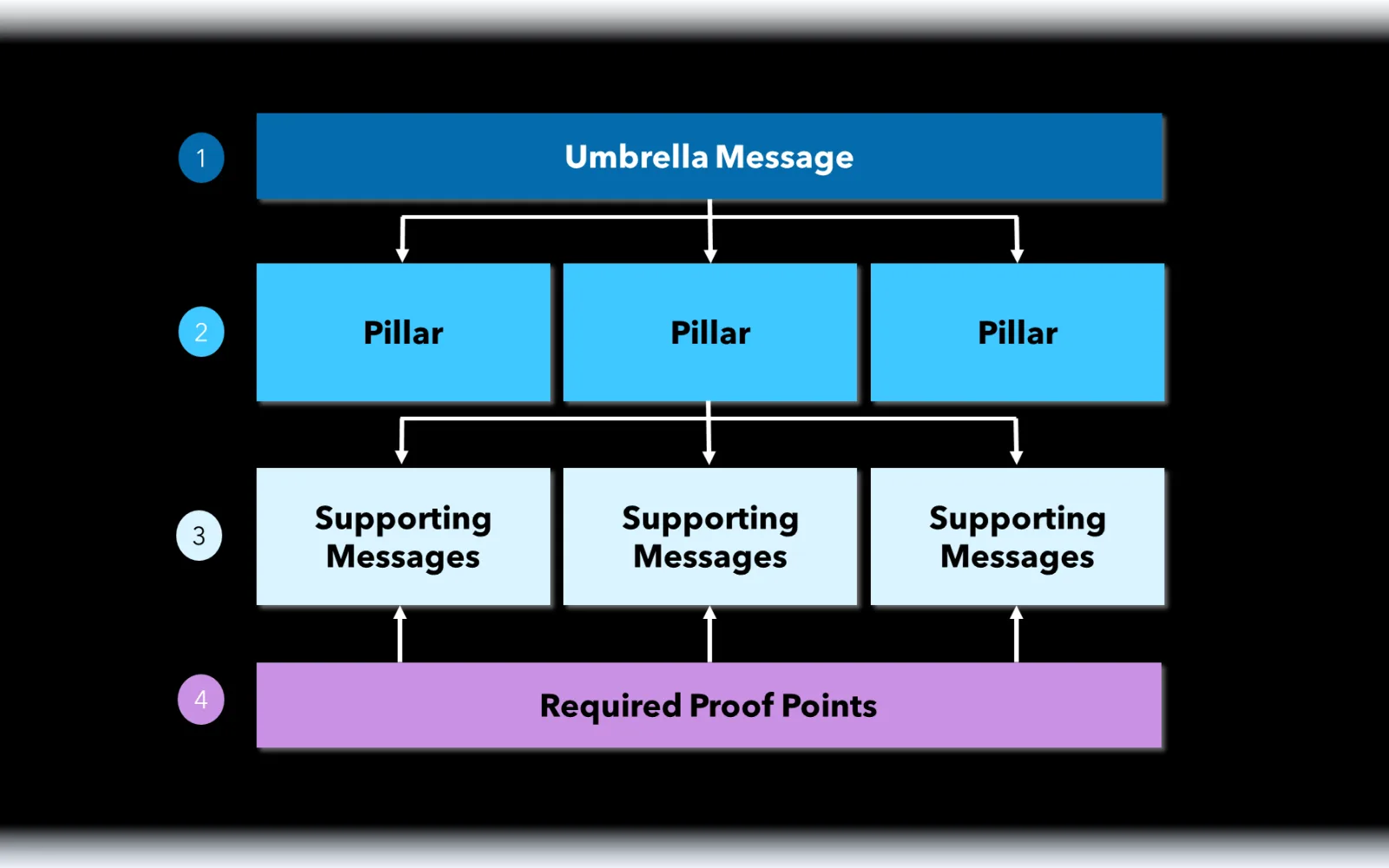

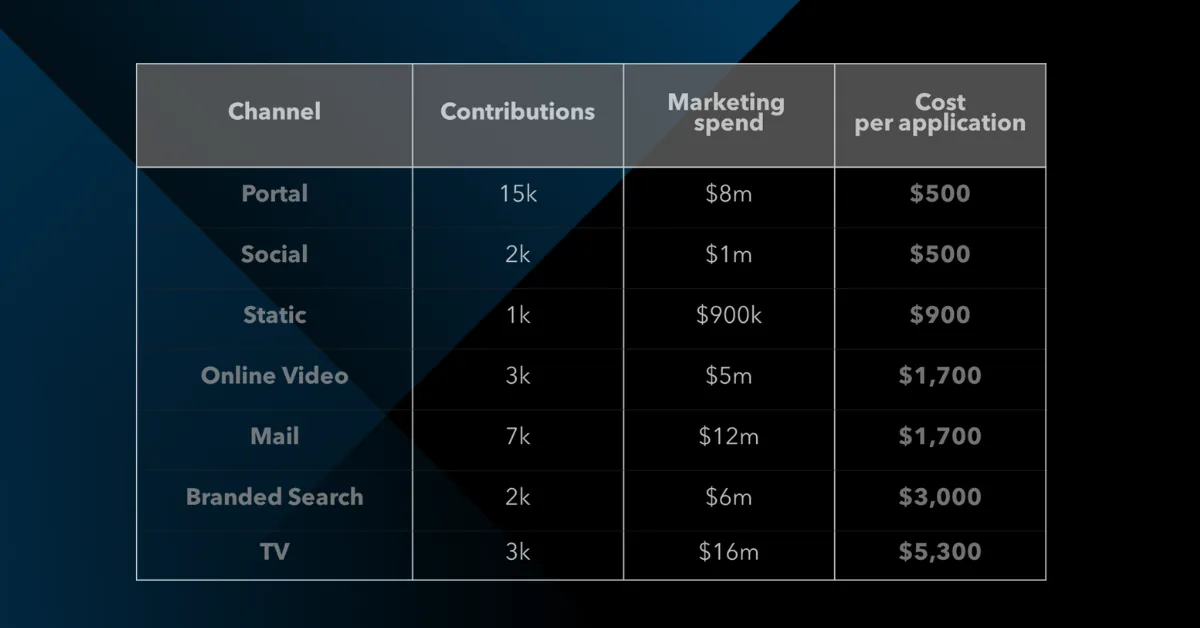

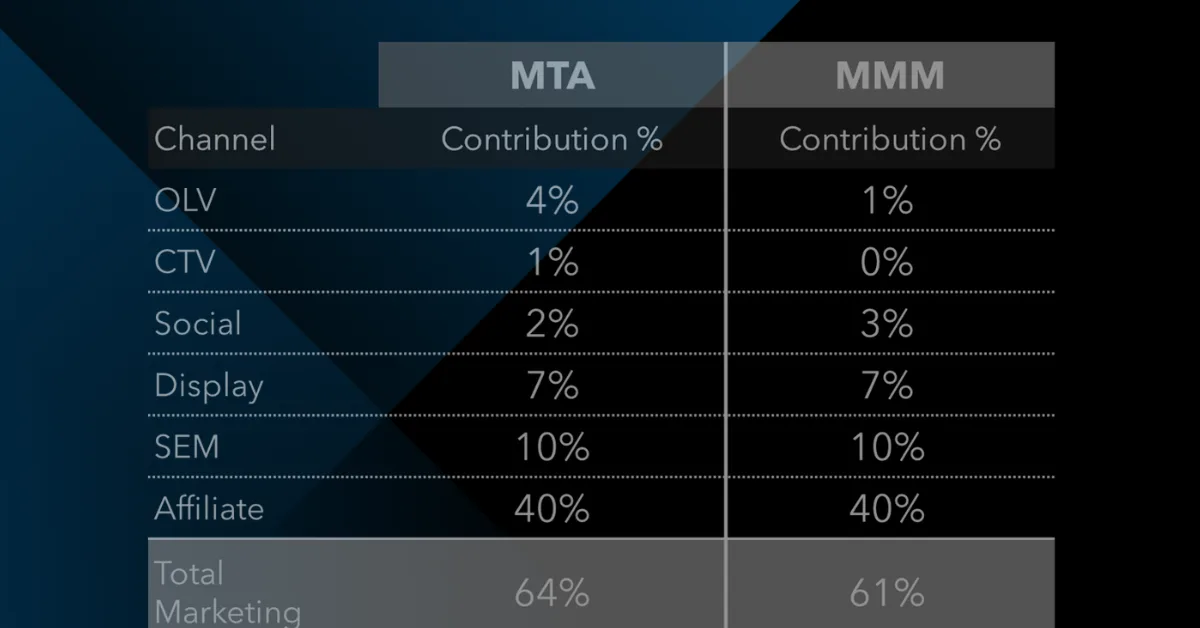

Marketbridge performed a baseline assessment of the current strategy and coverage structure. Customer segmentation, role definitions, territories, and marketing strategy were then analyzed. Significant gaps were found that needed to be addressed within each area of focus. Marketbridge identified three distinct sales plays that the client could utilize to enable future growth opportunities.

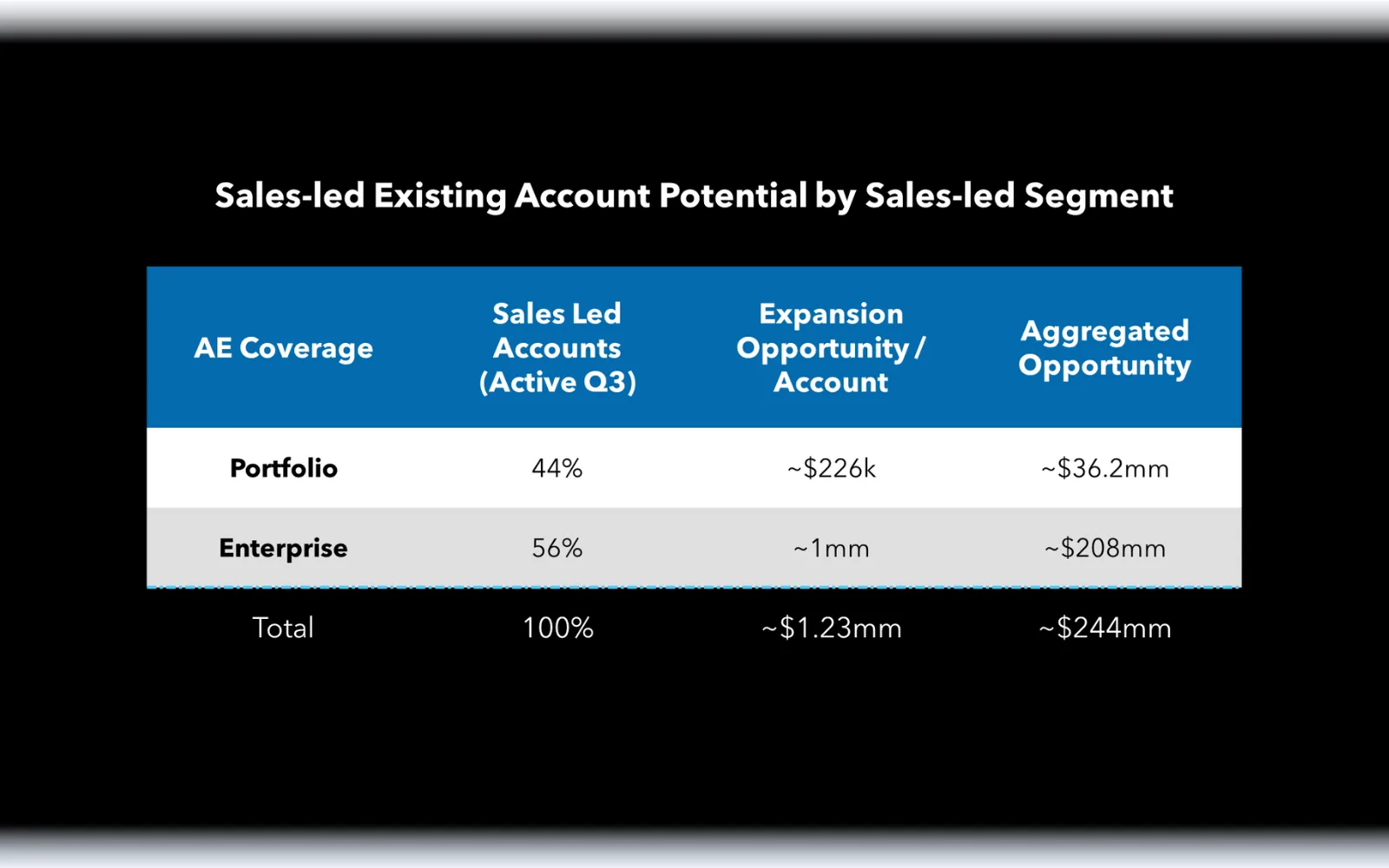

Step 2: Segmentation, role definition and coverage design

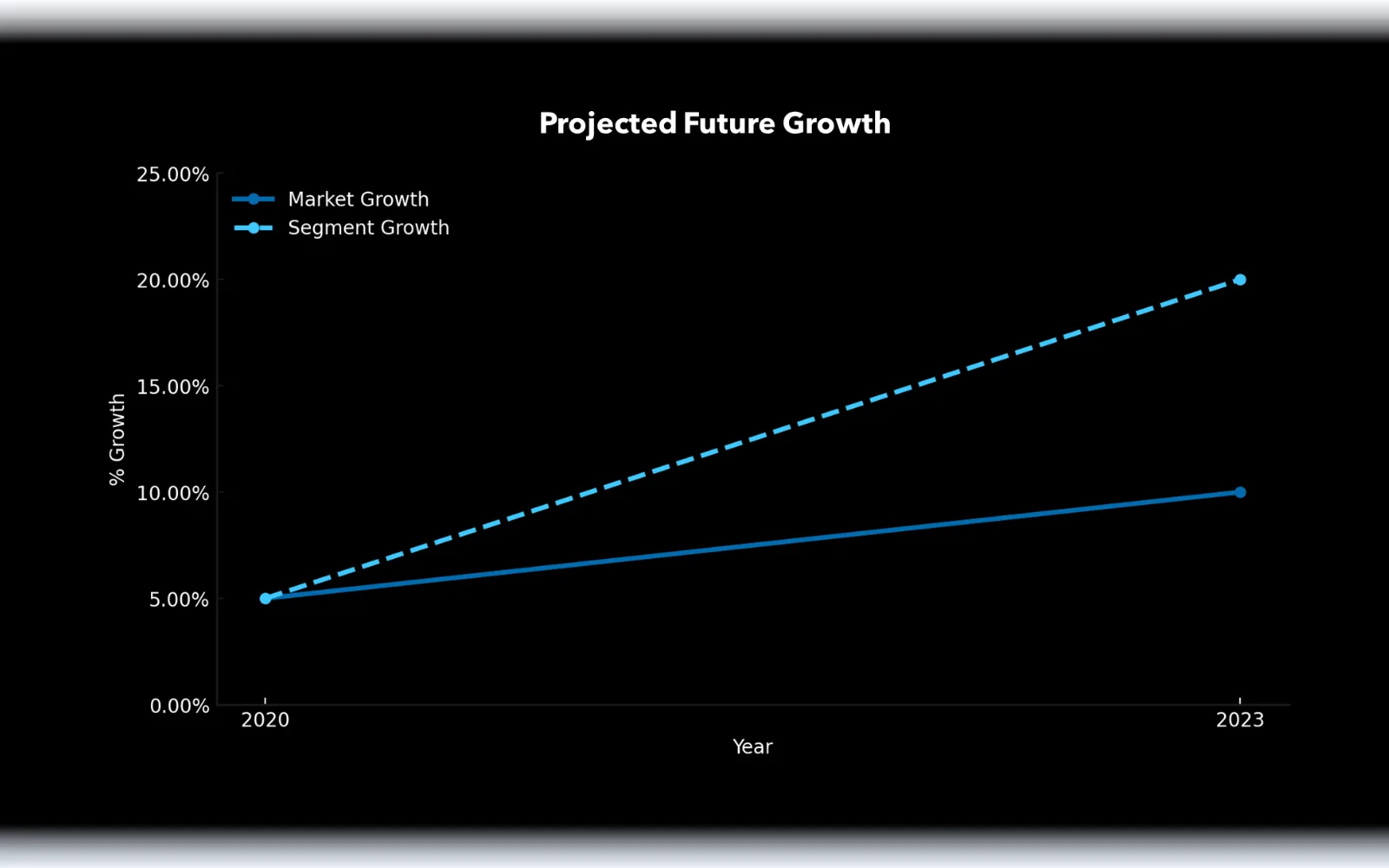

Using the information obtained in the baseline analysis, Marketbridge applied a data-driven approach to model opportunity at the account level—finding that ~75% of all ARR and opportunity fell within the top two deciles. This calculated information was then used to suggest alternative segmentations that could be aligned across roles and throughout the sales process. The new design also included updated role definitions, allowing for more specialization and deeper knowledge of the requirements. Marketbridge also recommended a reallocation of current accounts and a change in coverage design—considering time zones when allocating both existing and new accounts to ensure that resources could engage with clients consistently and influence future hiring strategy.

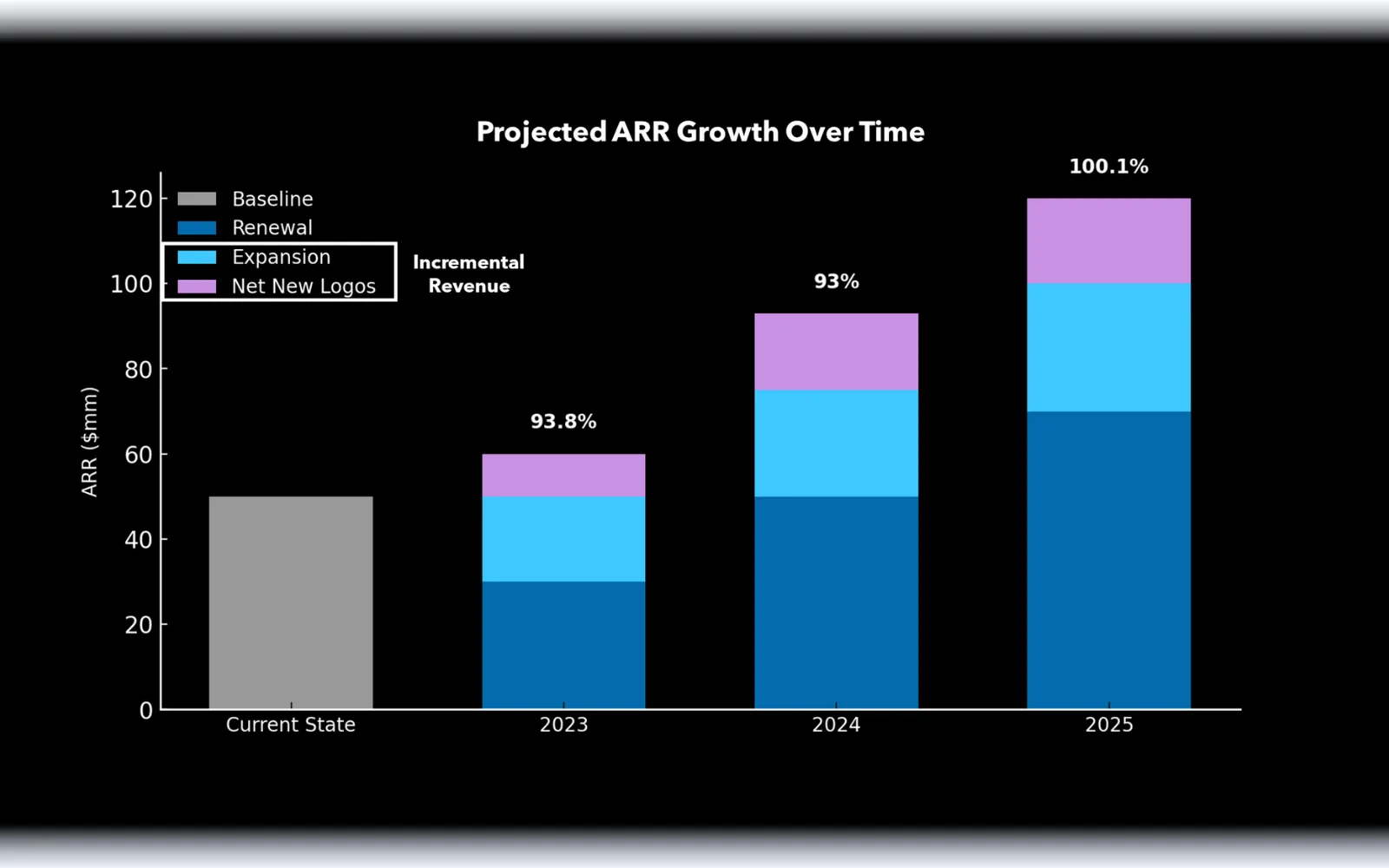

Step 3: Implementation of territory models, compensation and coverage design

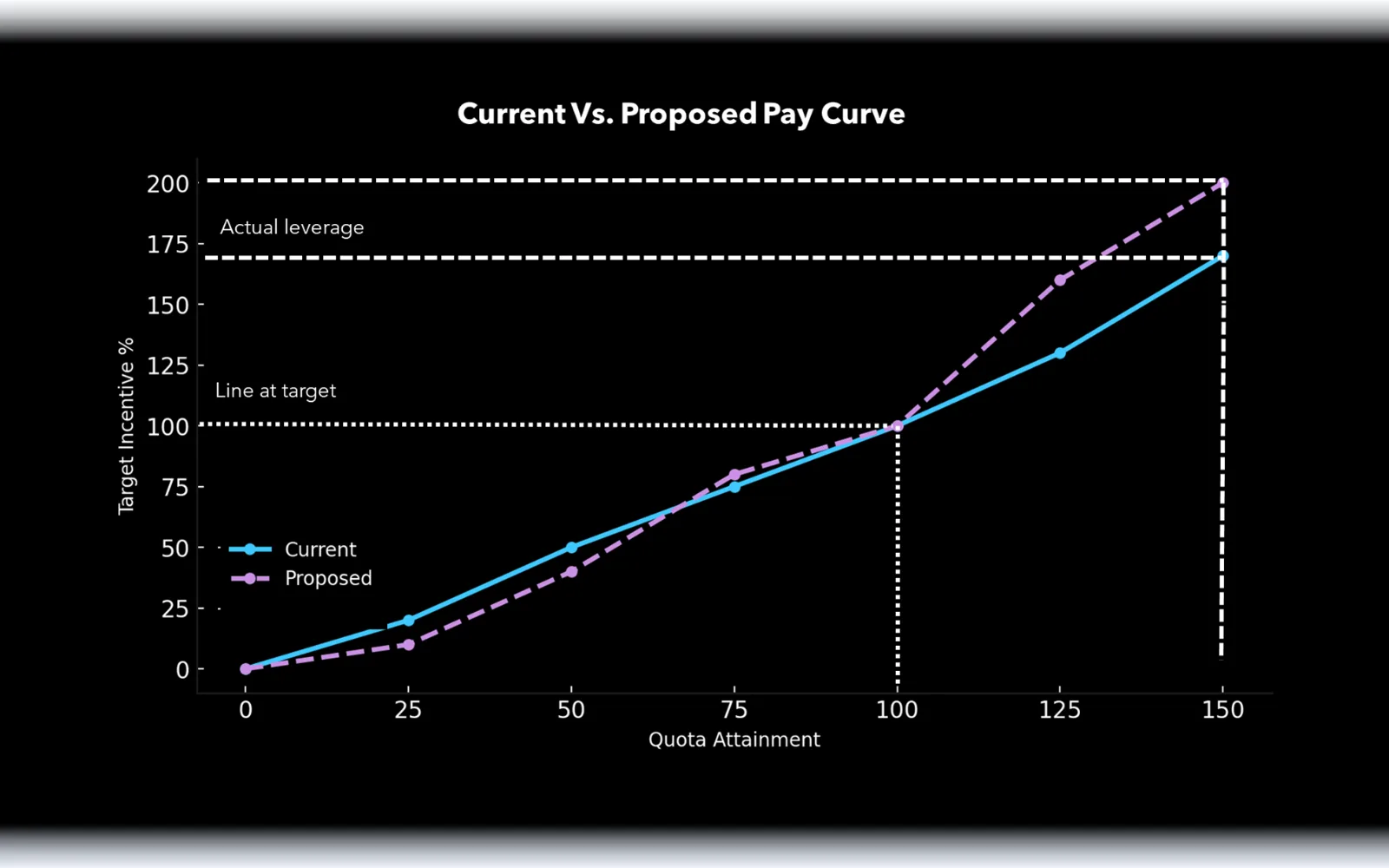

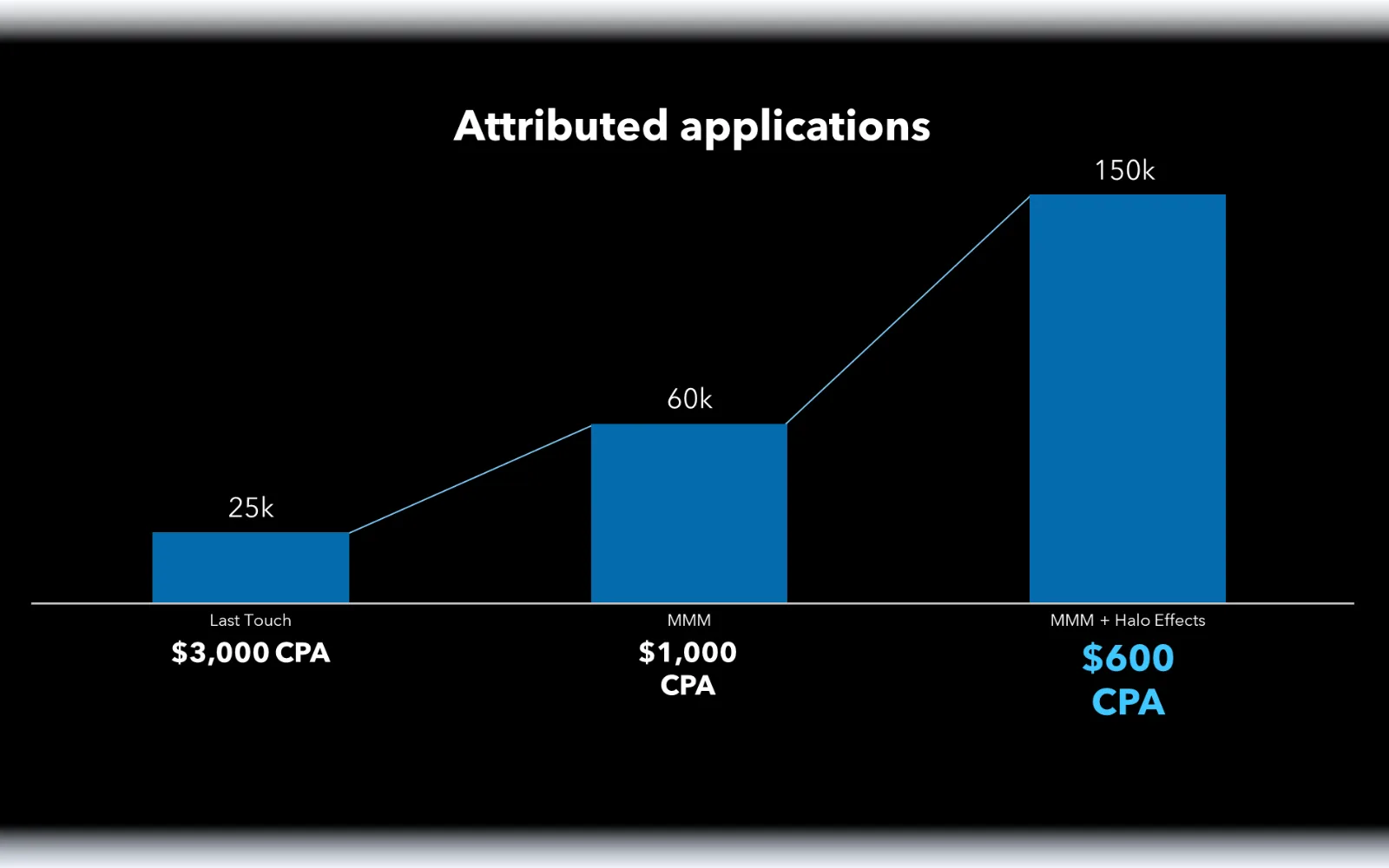

These recommendations were translated into a driver-based financial model for the new fiscal year. The model incorporated channel economics to ensure a profitable and highly scalable approach to growth. It created new dynamic territories and more evenly allocated accounts across the Sales team. With this, the client could enable dynamic territories and optimize resource allocation over time. In addition, new sales compensation plans were outlined to pay for performance and align incentives with role requirements. Roles were then allocated across the sales cycle in a detailed coverage map that clearly defined each person’s role through each phase

Business impact

Primed for future growth

42% improvement in sales efficiency and target attainment

With the new account allocation, opportunity was evenly distributed across sales staff. This decreased expense to new bookings by 42% and allowed all sales staff to reach target ARR goals. Detailed roll definitions also improved connectivity and collaboration throughout the sales process.

Greater alignment of Sales and Marketing functions

Improved coverage structure helped align future sales plays and marketing efforts. This allowed both teams to communicate a consistent value proposition to both existing and potential customers. Consistent segmentation also reduced the number of misaligned accounts to 0, allowing for more collaboration across all departments and roles

Scalable go-to-market strategy for ARR growth

Our implementation has influenced a net ARR increase of 130%. New dynamic territories created by the model enabled the client to distribute new accounts across the Sales team effectively as their customer base grew. This more efficient allocation of resources ensures consistent customer engagement and can adapt, continuing to promote revenue growth.