Marketing effectiveness case study

Behavioral segmentation improves brand marketing ROI

The challenge

How much does brand marketing really drive new customer growth?

A client in the internet security space was struggling to drive meaningful growth. The category saw increased competition with lower-cost products entering the market, claiming incumbent market share.

Despite increased marketing investment, our client’s revenue was flat. The New Customer segment was showing some growth, but other business metrics weren’t improving.

The objective

Optimize brand efforts

The client wanted to understand if recent brand efforts were effective in acquiring new customers and how to optimize their investment for the purpose of additional growth and scale.

Part 1: Understand new customers

Find the drivers of growth in the new customer segment by exploring:

- Behaviors and demographics

- Product mix

- Sale trends

Part 2: Model brand responsiveness

Model brand efforts’ impact on sales using media mix modeling (MMM) in order to:

- Prioritize channels

- Optimize brand campaigns

- Measure brand marketing ROI

The solution

Advanced brand modeling based on behavioral segmentation

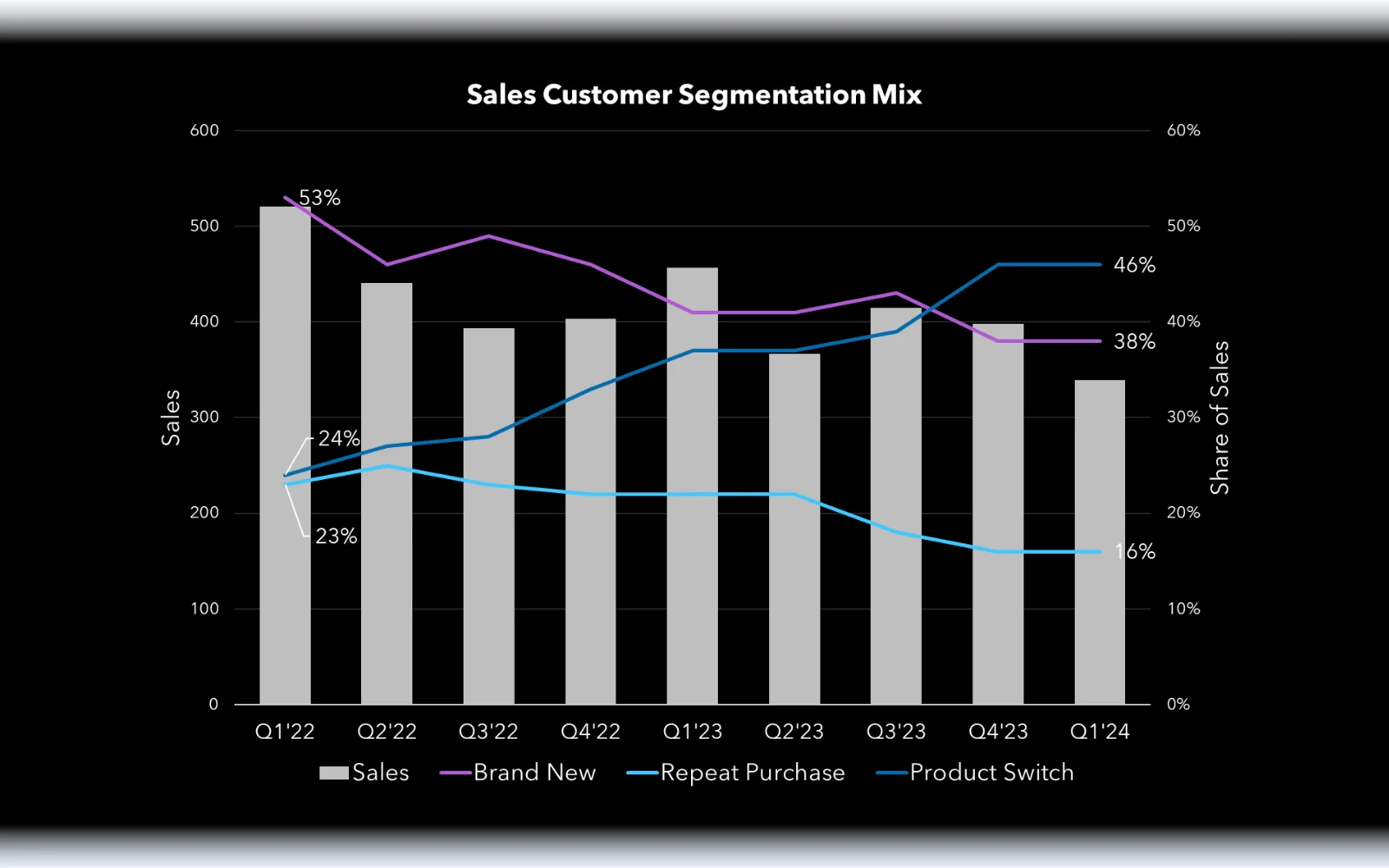

We uncovered that the “new customer” segment was actually two distinct segments combined into one: customers who were truly new acquisitions and those who had upgraded their product from a previous version.

Combining these two segments camouflaged a shrinking pool of brand-new customers, as the upgrader group was the segment showing real growth.

Part 1: Create behavioral segments

We leveraged internal client data to enable more accurate and actionable audience segmentation:

(A) Behavioral Segmentation

Defined mutually exclusive, collectively exhaustive (MECE) behavioral segments using existing data

(B) Segment Deployment

Deployed new segmentation in the client’s marketing database for real-time audience targeting and conversion labeling

(C) Segment Reporting

Developed reporting on these segments over time to validate shifts in audience mix align with the client’s strategic goals

Part 2: Quantify new customer brand engagement

We used media mix modeling (MMM) and multi-touch attribution (MTA) to determine which channels drove purchases among the newly defined brand-new customer segment:

(A) Measured channel effectiveness

Built effectiveness models to determine the channels and platforms that had the greatest impact on brand-new customer acquisition, generating marginal response curves to aid in scenario planning.

(B) Calculated true marginal cost-per-acquisition

Econometric models revealed that brand investments were highly effective at generating new customer acquisition.

Unsurprisingly, these efforts did little to entice product switchers. Splitting out these segments pointed to significant budget readjustments.

Business impact

Brand campaigns targeting the right segments led to improved ROI and growth

With our insights and recommendations, the client was able to increase their marketing ROI and optimize their budget towards increasing both brand-new and existing customer conversion rates.

Improved targeting

Look-alike audiences under the former “new customer” segment yielded poor targeting and muddled segmentation.

Leveraging the “brand-new” customer segmentation resulted in better targeting and improved conversion rates, decreasing acquisition costs.

Optimized brand investment

Brand awareness efforts attracted brand-new customers, while more mid-funnel activities and affiliates drove product switching among existing customers. This insight led to executive approval to move budget up-funnel to acquire more brand-new customers.

The client also moved existing customers into up-sell campaigns and suppressed them from new customer acquisition efforts to improve ROI across both initiatives.