With the tech economic slowdown likely extending into 2024, businesses must adapt their resources, budgets, products, and partners to the new selling environment. As buyers delay large transactions, subscription services that are cost-efficient or vital to daily operations (like SaaS for payroll) will gain prominence. Given tech firms’ reliance on channel partners to seize market opportunities and deliver value-added services, companies must ensure their partners can effectively develop and sell new Anything-as-a-Service (XaaS) solutions.

Our direct client feedback and survey responses revealed that partners often struggle to adapt customer experience and solutions to embrace new XaaS-driven revenue streams. In the pursuit of XaaS success, tech leaders face three prevalent channel partner challenges:

- Misaligned Go-to-Market Objectives

- Unmet Service and Delivery Expectations

- Lack of Data-driven Engagement Models

1) Misaligned Go-to-Market Objectives

Swift pivots to XaaS models can result in inconsistent and confusing partner strategies and programs. Whether due to a lack of strategic vision or a lack of partner communication, it’s not uncommon to find a company trying to run two partner program “flavors” at the same time—one for traditional on-premises sales (which might be a large legacy revenue stream) and another for XaaS selling (which has different channel partner program characteristics). Businesses that haven’t thought through where XaaS revenues will come from and which partners are best positioned will struggle to grow.

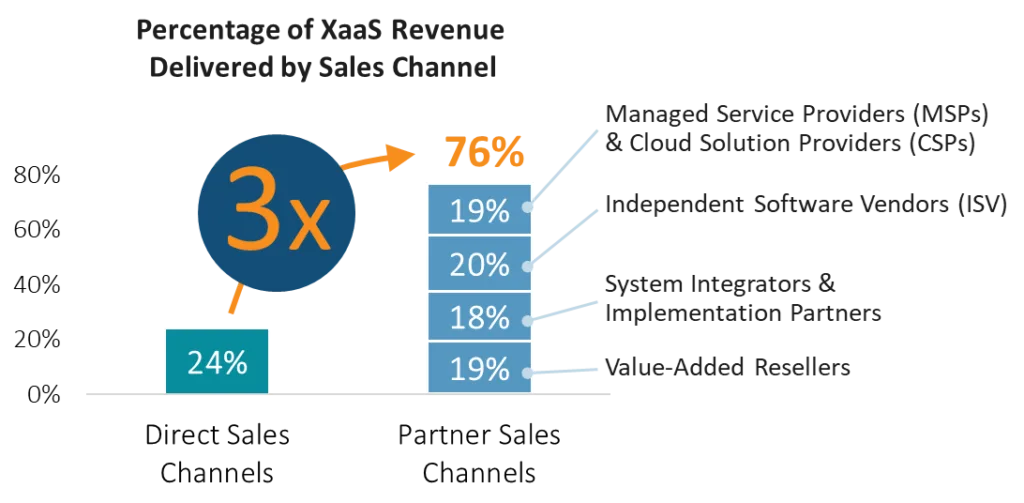

Partner sales channels deliver 3x more XaaS revenue than direct sales channels (Figure 1), but not all partners are created equal when it comes to XaaS suitability. Managed Service Providers (MSPs), Cloud Solution Providers (CSPs), and Independent Software Vendors (ISVs) are best positioned to deliver clear recurring value to line-of-business decision-makers because they are embedded in their operations, delivering always-on outcomes with the potential for “moment of truth” experiences. Traditional Value-Added Resellers (VARs) and System Integrators (SIs) are more transactional, with client interaction on an “as needed” basis with extended time between purchases. During economic slowdowns, VAR and SI partners are far more likely to experience delays in client purchases, hurting a company’s potential to drive XaaS revenues.

The Fix: Align Objectives and Deliver on New Goals

To remedy misaligned go-to-market objectives, there are two primary areas of focus. First, redefine and quantify where new as-a-service revenue will come from (in other words, prioritize your growth pathways). Second, once the market opportunity has been refreshed, make the necessary partner network adjustments to your channel strategy, capture new revenue, and focus on partners with stickier relationships with clients.

2) Unmet Service and Delivery Expectations

Partners’ struggles to meet service and delivery expectations have become more complex with the introduction of XaaS offerings. The days of simply selling and installing a solution are over. To maintain a subscription contract and potentially expand it with add-on services, partners need a broader set of skills for ongoing support.

While many traditional partners have tried to enhance their customer service abilities, this transition has been slower and more challenging than businesses initially anticipated. As a result, partner performance has suffered, leading to dissatisfaction among tech firms with their partners’ capabilities throughout the sales process.

The Fix: Enable and Train “XaaS-Ready Channel Partners”

To tackle this challenge, companies should enhance partner skills in new delivery models and recruit and enable top XaaS-ready partners. Expectations also need to be clearly defined for each partner type. Along with training partners, setting thresholds of competencies/certifications, tracking performance against those expectations, and intervening on an ongoing basis can course-correct each partner and raise the performance bar for each and all.

3) Lack of Data-Driven Engagement Models

XaaS solutions generate an abundance of data, yet many partners lack the capabilities to use these new datasets to deliver value for customers. Businesses must aid partners in harnessing data, conducting analysis, and prescribing better experiences. With only 30% of respondents “very satisfied” with how XaaS partners service their customers with great experiences, honing in on the data and using it to build a better experience is a first start.

The Fix: Build an Always-On Insight Engine

With subscription and hardware-as-a-service solutions, businesses have access to individual and aggregated customer usage data that was previously unavailable. Companies can use these insights to prescribe to partners precisely what message to deliver to customers based on usage behavior, but they must first invest in building the data analytics solutions to extract that data. We call this an “always-on insight engine,” one that feeds actionable intelligence to specific partners in a conveyor belt fashion. A constant stream of actionable insights (“Hey, partner. Here’s what you can do now and why.”) will not only strengthen the vendor-partner relationship but drive incremental sales.

Overcome Challenges in the Race to XaaS Success

CROs must refresh channel strategies to outperform the competition. To deliver the predictable business outcomes and customer experiences needed for a winning subscription model, companies must focus on finding the right mix of partners, enhancing those partners’ skill sets, and leveraging customer usage data.

Download our report, “A CRO’s Guide to Transforming the Channel for XaaS Success.”

In this report, built from quantitative benchmarks and interviews with industry leaders, we dive deeper into the challenges presented in this blog and provide a four-step path to move forward.