The modern benefit admin ecosystem is a sprawling system defined by fragmented channels, complex integration paths, and deeply regulated products. For the proactive benefits marketer, staying on top of this rapidly evolving playing field requires a toolkit of integrated analytic and technical capacities. Those who fail to adapt will quickly find themselves falling behind. Winning in this space requires marketers to adopt three approaches that enable smarter, data-driven execution.

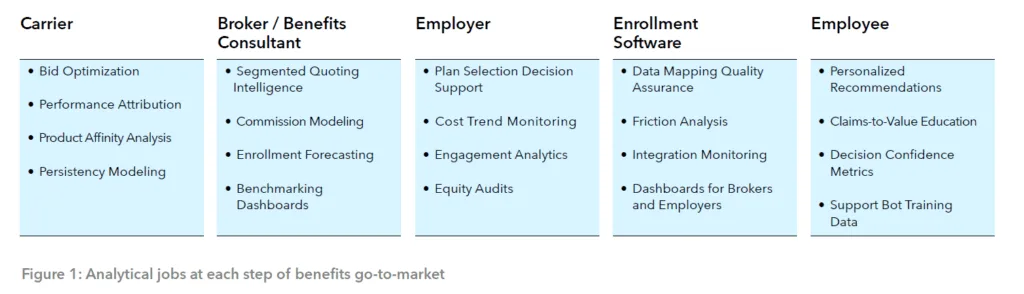

1) Making go-to-market a data-driven discipline

In the modern financial services environment, a successful marketer is part analyst, part growth hacker, and part systems architect. Cutting-edge marketing strategy aims to measure incrementality, test and re-test creative performance, gauge audience potential, and understand channel-specific ROI. All of this must be continuously optimized. In the Ben Admin space, this means tracking the entire benefits choice lifecycle and working closely with sales teams to segment targets, pursue account-based sales strategies, and bring the right content to the right buyer at the right time. At Marketbridge, we take a use-case based approach to simplify this process into a series of “jobs to be done” for a quantitatively robust go-to-market strategy (Figure 1).

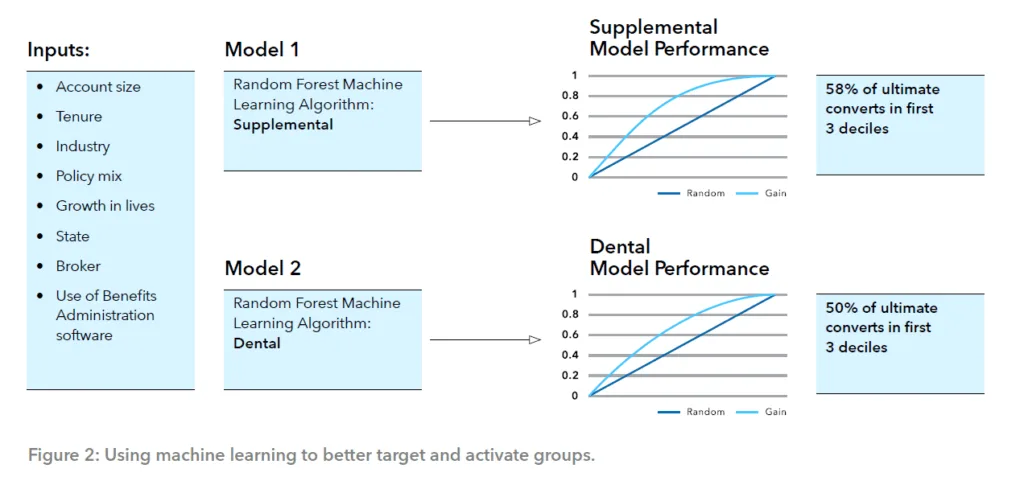

2) Micro-segmenting groups

It is now possible to build segmented activation strategies not just by employer size and geography, but also by industry vertical, renewal cycle, benefit portfolio, and even internal HRIS configuration. Strategies utilizing machine learning techniques can create targeted activation based on factors such as account size, tenure, industry and policy mix. In the example below, these factors were used in a random forest model to score groups for marketing activation during the open enrollment period, and half of all converters were accurately predicted by the top 3 deciles. This allowed for more targeted and efficient marketing activation and conversion strategies across the funnel (Figure 2).

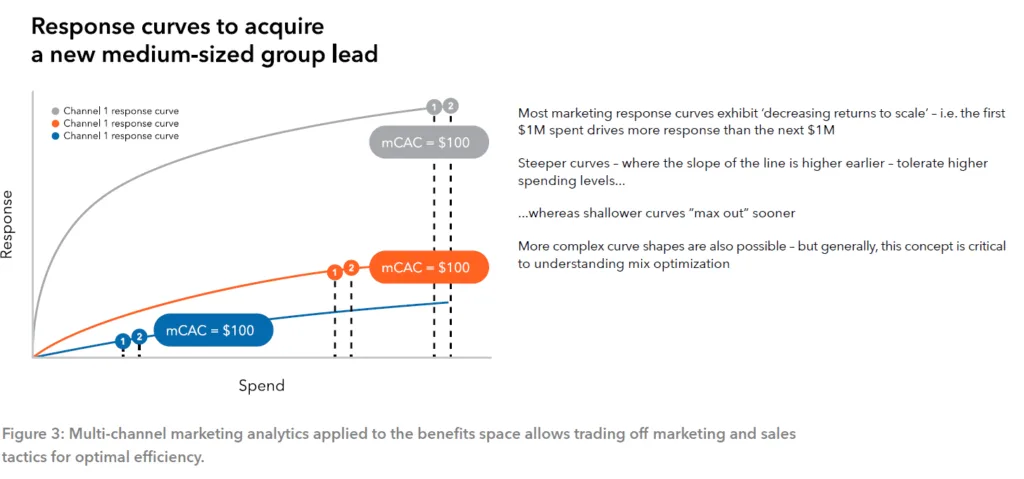

3) Remixing digital channels for real enrollment lift

Employee benefits marketing must now account for the complete activation and retention funnel, requiring fluency across multiple digital channels and the ability to test channel mix optimizations in all stages of the buying cycle. Techniques like MMM (media mix modeling) and MTA (multi-touch attribution) can determine which tactics and channels drive groups and employees towards decisions, and powerful open-source data science libraries make these methods accessible to anyone with data. In Figure 3 below, the output from a typical MMM shows how three different channels reach the same CAC (customer acquisition cost) at very different spend levels—implying an optimal mix for maximum effectiveness and efficiency.

Why this matters

The benefits market is still highly competitive, but this won’t last forever. Carriers and brokers still operating with a traditional marketing mindset will find themselves increasingly left out of bids, while those willing to modernize their marketing and sales teams will rise to the top. The next generation employee benefits marketer won’t be “digital” in the superficial sense—they’ll be technical, data-fluent, and operationally embedded across the entire go-to-market stack.

Download our whitepaper, “A new golden age for employee benefits”

Discover how GTM leaders can cut through complexity and unlock growth.