Segmentation empowers businesses to tailor their marketing efforts, optimizing resource allocation for higher customer engagement and increased sales. Yet despite the positive results, many businesses fall short in their segmentation and targeting efforts. They often struggle to identify the right segments or target inappropriate market sections. This misstep usually stems from a lack of quality data, misinterpretation of market dynamics, or inadequate understanding of the business’s unique value proposition. As indispensable tools for businesses aiming to navigate the intricacies of the market effectively, this blog dives into common pitfalls and best practices of Segmentation and Targeting acting as a comprehensive guide. As Theodore Levitt rightly stated,

“If you’re not thinking segments, you’re not thinking.”

Understanding Segmentation and Targeting

‘Segmentation’ and ‘targeting’ – these terms, central to marketing parlance, carry weighty implications for businesses worldwide. But what do they entail, and why is their implementation often riddled with pitfalls?

Segmentation refers to the process of breaking down a large, heterogeneous market into smaller, homogenous groups based on shared characteristics. These shared traits could span a wide range – demographics, purchase behavior, needs, or interests. The goal of segmentation is to simplify the complex universe of potential customers into more manageable, actionable groups. By segmenting the market, businesses can streamline their decision-making processes and allocate resources more effectively.

On the flip side, Targeting pertains to the process of selecting particular market segments that a company considers most profitable or relevant. After segmentation identifies and organizes these segments, targeting swoops in to determine which of these segments to focus on and engage with.

A Fine Line: Differences between Segmentation and Targeting

Although used interchangeably in casual conversations, segmentation and targeting when viewed from a marketing lens carry distinctive meanings and roles.

Segmentation zeroes in on splitting the total market into meaningful groups. It involves organizing accounts and roles within those accounts into distinct groups, providing revenue leaders with a comprehensive picture of the most lucrative opportunities.

Targeting, conversely, focuses on the selection of specific segments for engagement. Targeting is all about deliberate decision-making—choosing segments deemed valuable for business while disregarding those that do not align with the business’s strategy or objectives.

The Art and Science of Segmentation

The world of segmentation is vast and varied, with multiple approaches, potential pitfalls, and best practices. Let’s take a deeper dive into these aspects.

Approaches to Segmentation

In the B2B space, segmentation is usually driven by the size of the accounts. The bigger the accounts, the higher their complexity. However, this complexity brings along with it a higher revenue potential and more appealing transaction economics. Smaller accounts, although easier to deal with, often yield lower transaction sizes and lesser revenue potential.

A commonly adopted approach to B2B segmentation entails dividing accounts into opportunity tiers. Although these tiers may vary depending on the specifics of a business, they typically include:

- Key Accounts: Comprising 10-100 accounts, these are Fortune 500 companies (or their international equivalents) that are high-volume buyers.

- National Accounts: Typically 50-500 accounts, these are Fortune 1000 companies (or their international equivalents) with core needs that the business can cater to.

- Core Accounts: Ranging from 100-1000 accounts, these are large, complex accounts that demonstrate a clear need for the business’s products or services, though they might be buying at medium-to-low volume presently.

- Small and Medium Businesses: Potentially reaching up to millions of accounts, these are smaller, simpler accounts that aren’t usually directly covered, but represent a significant revenue potential.

Another approach hinges on the concept of Total Addressable Market (TAM) and Total Serviceable Market (TSM). TAM provides a picture of the maximum market potential—a representation of the growth ceiling for a firm. TSM, on the other hand, filters TAM down to a more pragmatic subset of potential customers, using segment hypotheses.

The evolution of technographics has further revolutionized segmentation. Technographics offer valuable insights into companies’ technology stacks, use cases, and adoption rates. This information is particularly useful for businesses selling technology products or services, as it allows them to tailor their segmentation strategies based on the technology preferences and needs of their potential customers.

Pitfalls in Segmentation

Despite its advantages, the road to effective segmentation is fraught with potential pitfalls, including:

- Inside-Out Segmentation: Many businesses fall into the trap of relying on historical revenue to segment accounts. This approach often fails because past successes do not necessarily predict future opportunities, especially in dynamic markets.

- Grandfathering Account Classifications (Account Hoarding): Some organizations classify accounts based on pre-existing relationships, driven by the misguided belief that this lowers the risk of customer churn. This approach can lead to resource misalignment, hindering scalability.

- Creating Too Many or Too Few Segments: While segmentation aims to capture buyer-seller nuances, overly complex segmentation matrices can drive administrative complexity and additional costs. Conversely, oversimplified segmentation models may fail to account for differences in customer value and needs, leading to misaligned marketing and sales coverage models.

Best Practices in Segmentation

When done right, segmentation can unlock significant growth opportunities for businesses. Here are some best practices to guide your segmentation strategy:

- Keep It Simple: Aim for a balance of simplicity and discrimination by keeping the number of segments between three and five.

- Common Segment Understanding: Ensure sales, marketing, and service organizations use the same customer segmentation to promote cross-functional harmony and efficiency.

- State and Enforce Segment Policies: Establish clear guidelines, exception policies, and a governance process for account-segment assignments to maintain the structure of segments and make concessions for valid reasons.

- Stay Relevant: Reevaluate segments at least once every three years as part of your commercial planning process. This allows you to retrospectively assess segment performance and evaluate new segment hypotheses, keeping your segmentation strategy relevant as your business evolves.

The Art and Science of Targeting Buyers

In the competitive landscape of business-to-business (B2B) marketing, one crucial element stands out: targeting. This process, a meticulous exercise in resource allocation, involves prioritizing segments and accounts. As one might expect, this can be a contentious issue. Inevitably, someone in the sales force will be disadvantaged when their accounts are deselected, tying targeting closely to the mechanics of territory design.

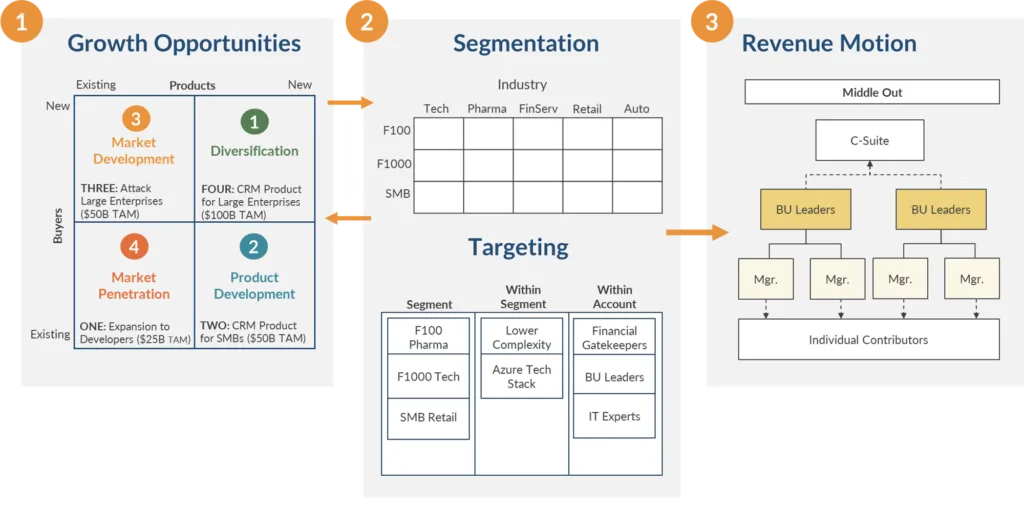

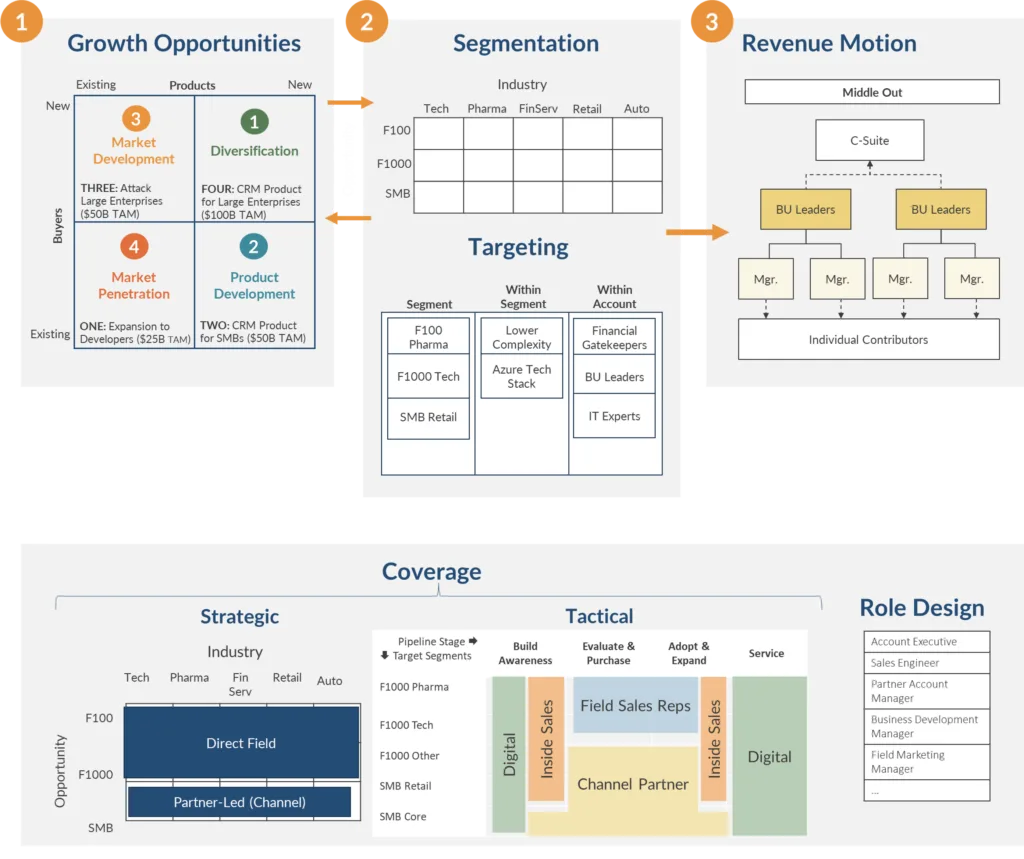

Segmentation and targeting can be thought of a series of magnification lenses—from wide angle (the total addressable market for the entire enterprise) to microscopic (individual buyer and influencer archetypes within accounts.)

Approaches to Targeting

There are three levels of targeting: Segment Targeting, Within-Segment Targeting, and Within-Account Targeting.

Segment Targeting

Segment targeting is the prioritization of segments defined in the segmentation exercise. This process might involve focusing on large enterprise healthcare companies for “Tier A” acquisition efforts based on opportunity, while explicitly stating that the focus will not be on large enterprise technology companies.

While the process of segment targeting is straightforward – with executives simply selecting segments for focus based on the segment hypotheses – the challenges lie in socialization, communication, and operationalization. This typically occurs in the annual forecasting and budgeting process, with the targeted segments receiving higher goals and more attention from both marketing and sales.

Within-Segment Targeting

Within-segment targeting has traditionally been a bottom-up process, primarily the responsibility of the sellers. They are typically tasked with examining the accounts in their territories and formulating plans to move existing opportunities through the funnel or to drum up new leads. However, these plans rely heavily on the sellers’ intuition and existing relationships, potentially missing significant opportunities.

Contrarily, a data-driven and scientific approach is a more effective method for within-segment targeting. Account data should be enriched with segmentation metrics in the CRM database and updated at least annually. This data can then be used to prioritize accounts within each segment. Seller input remains crucial, but ultimately, data, not emotion, should be the primary driver of targeting decisions.

Within-Account Targeting

Targeting can be refined further, drilling down to the specific buying situations and roles within accounts. Understanding buyer scenarios – the specific use cases that describe how buyers, influencers, budget holders, and users collaborate to generate the need, evaluate services and products, and make final decisions – is a qualitative, not a quantitative exercise. It requires conducting in-depth interviews, focus groups, or even observing stakeholders in their natural work environments.

Pitfalls in Targeting

Targeting in B2B marketing is not without its pitfalls. Missteps often involve a lack of in-depth research in Buyer Scenario Analysis, an overreliance on demographic data, and a failure to update and improve targeting strategies continuously.

- Overconfidence in Buyer Scenario Analysis: Revenue professionals, while often highly empathetic, can fall into the trap of overconfidence, leading to inaccurate buyer personas and purchasing scenarios.

- Overreliance on Demographics: While demographic data is easily accessible, relying solely on this can lead to a one-dimensional view of the buyer.

- Stagnant Targeting: Targeting strategies should be continuously updated and improved to stay current with the buyer population.

Targeting Best Practices

- Reliance on Data: While seller intuition is essential, data should ultimately drive targeting. Using enriched account data and segmentation metrics can help prioritize accounts effectively within each segment.

- Understanding Buyer Scenarios: Understanding the specific use cases of buyers, influencers, budget holders, and users can offer a clearer understanding of the buying dynamics and help in effective targeting.

- Continuous Improvement: Even the best targeting strategies can benefit from regular tracking and analysis of their effectiveness.

Unlock Growth Opportunities with Segmentation and Targeting

Segmentation and targeting, when understood and implemented effectively, are powerful tools for navigating the complex B2B landscape. They provide a comprehensive understanding of market opportunities, enable precise targeting, and support the deployment of resources in a cost-effective manner. However, as highlighted, these strategies can unlock significant growth opportunities.

If you are interested in diving deeper into these topics and want to establish a blueprint for growth in modern B2B, download the whitepaper “A Roadmap for Modern B2B Go-to-Market—Part 1: Growth Design.” This comprehensive guide will equip you with all the knowledge you need to navigate the complex landscape of segmentation and targeting successfully. So, don’t wait, download your copy today and start your journey to a more focused, targeted, and successful business approach.