When it comes to Medicare insurance marketing, leading payers must navigate the implementation of National versus Local media. Over the last few years, the top incumbent Medicare Advantage payers have spent 70%-80% of their media budgets on national media buys versus 20%-30% on locally based media.1 So, what’s the big deal? Make no mistake, the path to developing, implementing, and measuring a National versus Local marketing strategy is fraught with unique challenges.

From our experience working with top Medicare Advantage payers, we’ve identified three core issues causing friction. By addressing these issues, payers can improve strategic planning, implement more omnichannel marketing, and ultimately, drive membership growth:

- Poor cross-functional team collaboration

- Changing industry and market dynamics

- Complex media budget allocation and optimization

1. Poor Cross-functional Team Collaboration

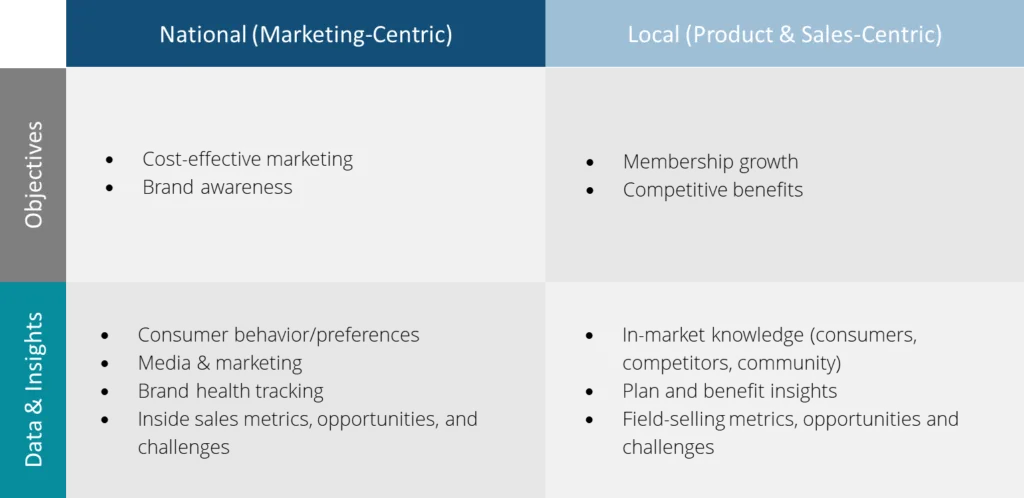

Poor cross-functional team collaboration is often rooted in conflict between different business objectives. While working with Medicare Advantage payers, we find that the National teams tend to be more marketing-centric and Local teams tend to be more product and sales-centric. That means, despite the value that can be tapped from collaborating, these teams tend to be more siloed than not. And when that’s the case, bringing teams together for planning and alignment can be a point of friction.

For example, when it comes to specific objectives, the National team is focused on cost-effective marketing. Since they have access to national media buys, they benefit from economies of scale; meaning they gain significant media cost advantages by reaching consumers across the national footprint. However, a key consideration in marketing across a national footprint is that messaging cannot include specific plan benefits that may vary from ZIP code to ZIP code due to CMS guidelines. This isn’t a disadvantage, as often National objectives like brand building or motivating a consumer to call to shop for a plan, can be successful without benefit-specific details.

However, when you’re a member of the Local product team that worked for months to invest in competitive benefits, it can feel frustrating not to see those benefits front and center in marketing messaging – especially if they present a competitive advantage. Local marketing can help showcase those benefits and bring awareness to market-specific circumstances, such as entrance into a new market.

Alignment to Goals and Omnichannel Messaging

Successful cross-functional collaboration is dependent on gaining alignment. The alignment of common goals and key objectives is a necessary starting point before media plans are designed. This cannot be accomplished without regular ongoing collaboration. Each enrollment or planning season, it’s imperative to reassess the short-term and long-term goals and objectives as they often shift in scope or priority. This process requires cross-functional updates that share consumer, product, marketing, and sales channel insights.

As you’ll see in the chart below both the National and the Local teams tend to be steeped in deep data and insights. And when this information is shared, it can unlock integrated media and channel strategies that can holistically advance a payer’s go-to-market strategy including landing on the right mix of National versus Local Marketing.

Figure 1: The National and the Local teams tend to be steeped in deep data and insights.

2. Changing Industry and Market Dynamics

Another issue that complicates optimizing the right mix of National versus Local marketing is changing industry and market dynamics. While the Medicare Advantage (MA) industry is experiencing growth, the “where” and “how” of MA growth are becoming increasingly nuanced (Chartis).

Medicare Advantage has seen record 2023 enrollment, with program participation adding 2.7 million beneficiaries, or YOY growth of 9.5%. Today, 48% of Medicare eligibles are enrolled in a Medicare Advantage plan (Chartis). And with 10,000 seniors “aging in” to Medicare every day, MA total enrollment is expected to grow from 64 million to 80 million by 2030 (Managed Care).

However, “how” to capture this growth has become more complex due to shifting consumer behavior, evolving CMS regulations, and a crowded competitive environment. Here are just some of the staggering facts:

Shifting Consumer Behavior:

- MA Switching: Consumers are switching MA plans at an increased rate. Deft Research reported that MA switching saw an increase during AEP2023 (the first time since 2019) to 15%.

- OM Contraction: Original Medicare is losing enrollees at a rapid pace. From 2022 to 2023 OM enrollment contracted by 1.3 million.

- Sales Channels: More than half of switchers enrolled through an Agent, and about a quarter of those via in-person meetings (Deft Research).

Crowded Competitive Environment:

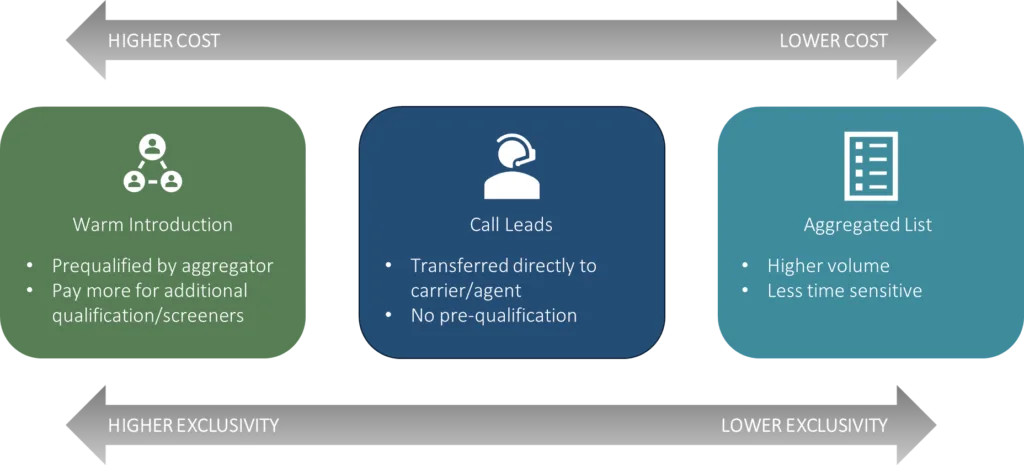

- Marketing Spend: 10% to 30% of the annual $2B AEP marketing spend comes from third-party aggregators/partner call centers, with the balance of the spend from payers.2

- Competitor Growth: While incumbents United and Humana accounted for 44% and 23% of enrollment, newer entrants delivered nearly 22% growth (100K lives) Devoted Health accounting for nearly two-thirds of this growth.

- Quality scores: 73% of MA beneficiaries are enrolled in health plans with 4+ stars.

Evolving CMS Regulations:

- Marketing/Advertising: From specific advertising language to tighter messaging based on plan availability, to new TV ad approval processes and timelines, etc.

- Third-Party Marketing Organizations: Stronger TPMO oversight, including beneficiary data collection and restricted distribution.

- Permission to Contact: Extended expiration dates

Nuanced Market-Level Dynamics:

- Disruptions: Competitive entrants, exits

- Target Audiences: Dual-eligibles, multi-cultural, etc.

- Plan Competitiveness: 5-star plans, MACVAT scores

If you didn’t think cross-functional team collaboration was important before, reviewing this list should emphasize the critical nature of coordinated planning amidst these complex and ever-changing dynamics.

Analyze the Four C’s

The reality of these conditions means regularly adapting your go-to-market plans and the role of National and Local marketing within them. Begin by reviewing the four C’s: Consumers, Competitors, CMS, and the Community. It’s a critical process for auditing the current and future state dynamics that payers need to factor into strategic planning, or else fall behind.

3. Complex Media Budget Allocation and Optimization

Allocating and optimizing marketing budgets across media and geographies is a common challenge. Most payers are using Marketing Mix Modeling (MMM) and Multi-Touch Attribution (MTA) analytic approaches to answer questions such as, “How did marketing impact the number of enrollments?” and “What is the true return on brand investments?”

Brand/Awareness Marketing

When it comes to upper funnel Brand/Awareness marketing, National and Local marketing face a similar measurement challenge. The objective of this upper funnel marketing is the attitudinal measures of awareness and consideration. This requires consumer survey data versus a KPI metric such as enrollments.

Where things differ is Local Marketing suffers from a lack of scale. More times than not, Local Awareness campaigns run for too short of a period to measure changes in behavior, or the marketing investment levels are too small to drive significant impact because thinner Local budgets were spread across too many Local markets at a time.

Lead Generation Marketing

When it comes to lower-funnel lead generation marketing, National and Local campaigns typically have the objective of driving a consumer response; a phone call, or filling out a web form. Measuring these types of campaigns can be straightforward, using last-touch attribution, though MMM and MTA models would provide a more accurate, holistic view of channel impact.

Measurement of any kind (last touch, MMM, and MTA) requires clean and consistent data. That means all marketing data should be exhaustive (including all channels), keyed (a reliable way to identify individual-to-channel interaction), and labeled (clear metadata to enable analysis).

This is where measuring Local marketing performance can encounter friction. First and foremost, if the teams setting up Local marketing campaigns are different than the teams setting up National campaigns, the processes for tagging, tracking, and capturing campaign data are often not universal. Unfortunately, this is typically the root cause of lost Local marketing data and insights.

Another issue that Local marketing must navigate is the end sales channel. Many times, Local lead generation campaigns route to local agents in the field, which adds a level of tracking complexity that can lead to lost attribution.

Inputs for Measurement Success

Best-in-class MMM and MTA models help payers understand the recommended marketing mix (across the funnel media) and geographies. But, simply having these models in place is not enough. It’s very important to audit these models to be sure both National and Local marketing data are regularly and accurately included as inputs. Media vendors change and feeds break, so don’t forgo this step. Ensuring accurate marketing data feeds will allow for a read on National and Local media tactics and the role they play in the consumer purchase journey.

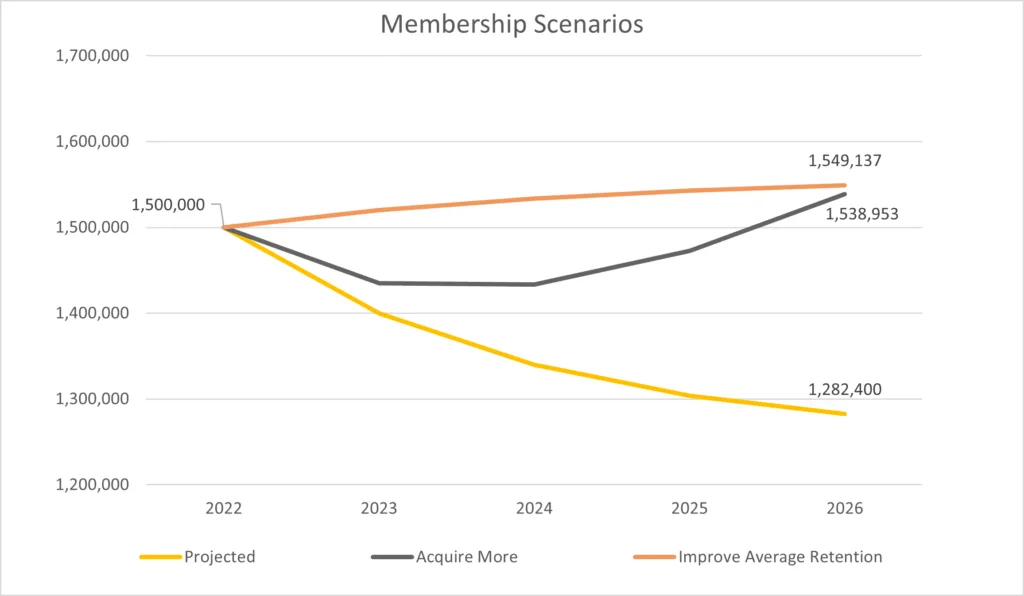

Finally, because Local marketing budgets are smaller, it’s imperative to have them work harder for you by honing in on location, location, location. There is no simple one-size-fits-all solution. This requires aligning business goals with market goals and assessing the market dynamics and marketing gaps to make the best choice. Sometimes, you’ll have invested in specific Local markets near-term for a quick win that season, other times you’ll invest in key markets to continue building a long-term path to enrollment growth.

Summary

Ultimately, it’s important to remember that both National and Local media reach consumers locally, and both have pros and cons depending on what you need to accomplish. Despite the challenges from the three common issues discussed, 1. Poor cross-functional team collaboration, 2. Changing industry and market dynamics, and 3. Complex media budget allocation and optimization—payers that do the work to address these issues can reduce friction points, improve strategic planning and ultimately, drive membership growth with a custom mix of National and Local marketing.

Download our whitepaper, “Navigating 5 Fundamental Shifts in Healthcare Marketing and Sales Channels”

For a more in-depth exploration of how to leverage local marketing strategies effectively, along with and four other disruptions impacting go-to-market strategy, download our whitepaper.

1, 2 Kantar Media Data, AEP 2022 & AEP 2023