Audience Insights case study: Behavioral segmentation improves acquisition efforts

A Marketbridge client in the identity protection space was struggling to drive meaningful growth. The category was experiencing increased competition with lower-cost products entering the market, stealing share from incumbents. Despite increased marketing investment, our client’s revenue was relatively flat. The new customer segment was showing some growth, but other business metrics weren’t improving. Here’s how Marketbridge helped the client understand whether recent brand efforts were driving the new customer segment, and how to optimize investment to drive additional growth and scale.

Seeking insights to optimize opportunities

The objectives of the engagement were two-fold:

Understand new customers

Analyze the new customer segment to understand drivers of growth and examine how the segment has changed over time to provide insights into how the client can enhance targeting in the future.

- Behaviors and demographics

- Product mix

- Sales over time

Model brand responsiveness

Use media mix modeling (MMM) to understand how the new customer segment responds to brand efforts and identify optimization opportunities for the campaign.

- Channels that perform best with new customer segment

- Optimization opportunities for brand campaigns

- Cost per acquisition ranges

Segment muddiness illuminate the root issue

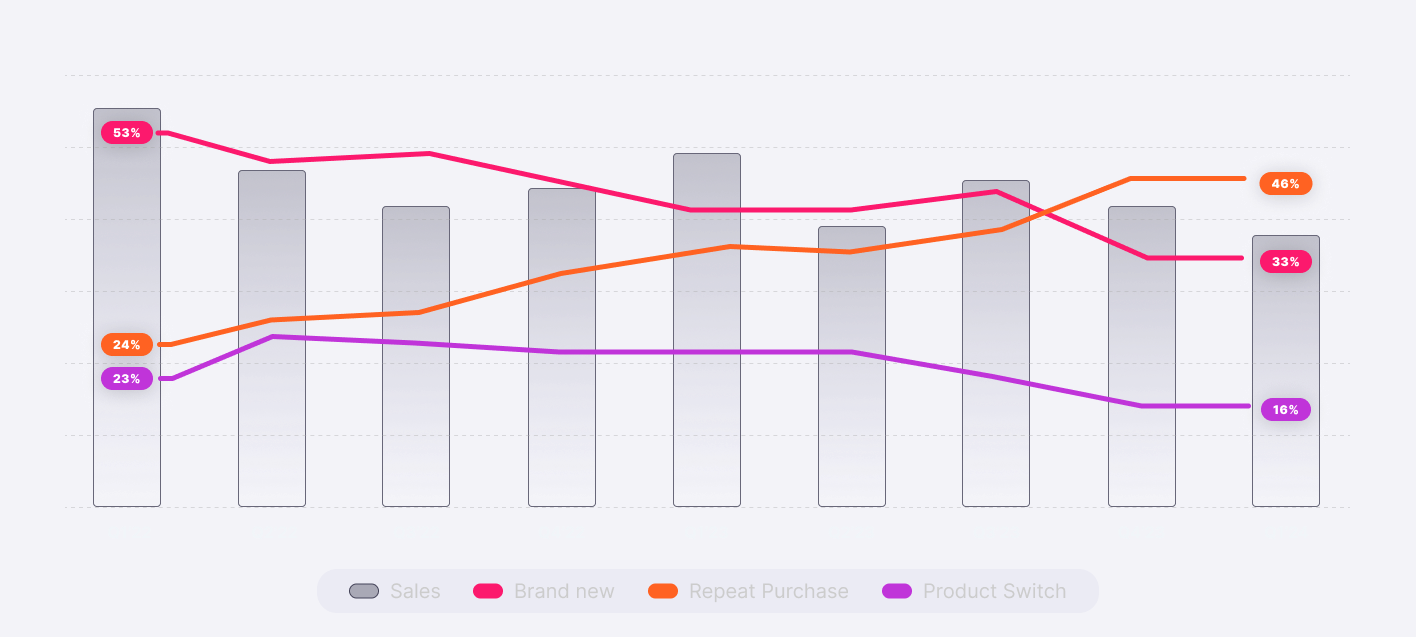

During analysis, we uncovered that the new customer segment was actually two distinct segments: customers who were brand new and returning customers who upgraded their product. Combining these two segments camouflaged that the brand-new customer segment was shrinking. We dug into the other customer segments and found similar issues and inconsistent logic that was hampering audience targeting.

Creating new

behavioral segments

Created data-driven behavioral segments that are mutually exclusive and collectively exhaustive (MECE)

Deployed new segmentation in the marketing database for real-time audience targeting and conversion labeling

Enabled reporting on these segments over time to ensure shifts in audience mix support client’s strategic goals

How brand-new customers

respond to brand efforts

We used MMM to understand which channels drove the brand-new customer segment to purchase and how to optimize for increased acquisition.

Provided clear insights on which channels and platforms drove the largest sales impact

Found that past brand campaigns did drive increases in brand-new customers, which was masked by previously combined segmentation

Created true cost per acquisition benchmarks for this brand-new customer segment

Improved targeting and optimized investment

Lookalike audiences using the former “new customer” segment had limited success due to inexact targeting and muddied segmentation. Leveraging the “brand-new” customer segmentation resulted in better signal and improved conversion rates, decreasing acquisition costs.

Perhaps not surprisingly, brand-new customers were attracted by awareness efforts, while more mid-funnel activities and affiliates drove product switching among current customers. This data led to executive approval to move budget up-funnel. Our client also moved current customers into upsell campaigns and suppressed them from certain acquisition efforts to improve ROI across both initiatives.