AI is transforming marketing, likely in ways we haven’t realized yet. From rapid content generation to programmatic advertising, marketers have obtained a new level of automation and insight that allows them to shift their focus to analysis and strategy. However, AI requires clean and comprehensive data at the foundation. One use case for the go-to-market data lake (GTMDL), the single source of truth between sales and marketing, is to power current and future AI use cases.

But what are the key building blocks for an AI-driven Go-to-Market Data Lake (GTMDL)? How are businesses leveraging cloud data warehouses and AI tooling to level up their marketing operations? What are the pitfalls? Let’s look at a few ways tech-led organizations are rethinking and rearchitecting their data, in view of the AI revolution.

Data as the foundation

Quality data is paramount for the underpinning of an AI infrastructure. Unsurprisingly, flawed input data leads to flawed analysis and output data. Without the proper attention to data quality, AI will simply provide the wrong results at a much faster pace. Many organizations fall into this trap – the best product in the world, either a CDP or homegrown solution, will fail if data architecture is not at the forefront of the design.

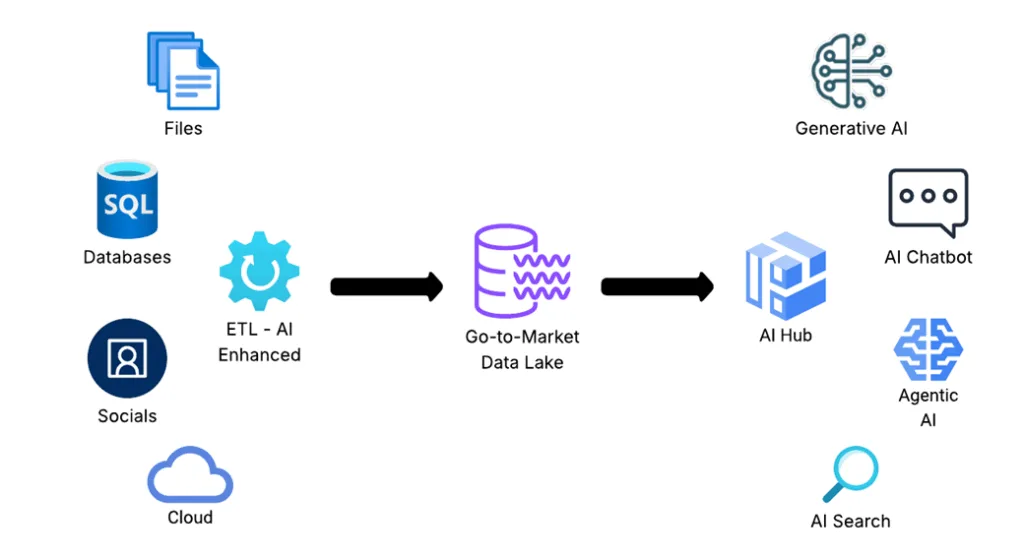

We believe the GTMDL is the answer to this problem. A carefully designed data lakehouse, tailored to your customers’ needs, serves as the foundation. The AI platform, integrated with the GTMDL, serves as the hub of activities and is where a Large Language Model (LLM), Retrieval Augmentation Generation (RAG), and other AI modeling are built and executed. With this base, AI operations can be executed with ease, providing content, insights, and recommendations in a fraction of the time it would normally take a marketing team.

Insights AI

A centralized GTMDL provides the bedrock: growth and scaling for both storage and compute. AI bridges the gap between humans and systems by putting the data at our fingertips. There are many insights to be explored, and AI tools are being capitalized on to provide these insights for marketers.

- Underlying data are now queryable by non-technical stakeholders, providing natural language search to SQL systems and removing the IT hurdle

- Predictive analytics churns customer data, both real-time and historical, anticipating future behaviors and calculating CLV

- Reporting agents do much of the legwork required to distill customer data into dashboards, allowing for more focus on the details

Generative AI

Generative AI, or simply GenAI, is likely one of the first areas of AI adopted by marketers and we’re seeing it significantly boost productivity. For example, consider the lift required to leverage an existing blog post or whitepaper as the source of a targeted ad campaign. GenAI can produce as many versions of the concept as needed and in the necessary format―whether that be text, image, or video―in a fraction of the time.

Using commercially available or free tools such as ChatGPT is a common route for most marketers looking to get started with AI and is great for many cases. However, AI coupled with the GTMDL is beneficial as an augmentation for many reasons:

- Data stays within the governance of IT, enhancing privacy and security

- Content is generated from internal sources and is more relevant

- Models can be trained and customized for different uses

Decisioning AI

How might AI enhance our decision-making process for something as simple as A/B testing? At the most basic level, AI can identify patterns in data that humans may miss, providing recommendations that will lead to more successful results. But we still must conduct the test and wait for the results, right? Not necessarily. An AI-driven GTMDL can be leveraged to learn on the fly and adjust recommendations. A single A/B test that may take 8 weeks can be accomplished in much smaller periods, such as 2 weeks, increasing the number of experiments within the timeframe. Response data from the test is continually received and ingested back into the model, informing us of the success of the test cases. AI decisioning subsequently adjusts the recommendations and provides alternate tests that are then adjusted in downstream campaign platforms. As we continue to feed this data back into our GTMDL, along with all the other data points we are gathering, we gain a deeper understanding of our audience and create a system that is nimble and responsive to the market.

Key watchouts

We’ve covered a handful of great use cases for marketing teams to implement an AI-driven GTMDL and there are hundreds more. We also should pay close attention to a few factors that will impact your outcomes, such as governance, cost, and data quality.

Governing how AI is used within an organization is important to reduce risk, protect sensitive data, and establish guidelines for responsible use. With AI in its infancy, it’s important to establish as many guardrails as needed without hindering the exploration process. One failure, such as improperly handling PII, will be devastating.

Be mindful of cost―AI is storage and compute intensive. Carefully architecting AI systems is important to control runaway costs and stay within budget. Start with small data sets that don’t require immediate results and 24/7. Also, enabling spending limits where possible is a must.

Most importantly, as stated previously, the data quality is crucial. The term GIGO (Garbage In, Garbage Out) may seem trite, but it certainly still applies. Investing significant amounts of capital in AI without proper oversight of the data will result in less effective, if not useless, outcomes.

Conclusion

Current and future AI uses for marketing and sales will require clean data and strong taxonomies and metadata. Smart organizations are building a flexible and scalable go-to-market data architecture that can be AI driven—now or in the future. Granular data in an organized structure readable by AI can power current use cases like propensity modeling and segmentation and prepares for future use cases like real-time media optimization.

Check out the GTMDL whitepaper here to learn our vision and approach to AI, data, and Martech. Data is the key to your success, and we can help!