Marketing Effectiveness case study: Building a simple, actionable, measurable brand model

A premium personal care brand wanted to quantify brand strength to review which marketing efforts and strategic initiatives moved the needle, and to reveal the relationship between brand strength and sales. The client was faced with myriad data that provided competing signals: awareness was trending up while share of voice was dropping, product reviews had never been better while new customer acquisition was trending downwards. These mixed messages made it difficult to evaluate the relationship between a recent brand campaign and the brand itself, let alone the linkage to revenue.

Stitching together a complete brand picture

To better understand the relationship between company efforts and brand strength, and to stitch together a picture of the indirect impact that “brand” has on eventual sales, we set out to coalesce the company’s variety of brand data sources into a set of simple, actionable and clear brand metrics. With a time-series view of these metrics, we then reviewed the impact and temporal lag of marketing and PR efforts.

Keywords:

Marketbridge Brand Measurement Framework

Building a unified brand metric(s)

We gathered all data that might be either an indicator or a driver of brand strength by meeting with data owners and analysts across the company. After normalizing the data and aligning time granularity (daily vs. monthly, etc.), we used Structural Equation Modeling, paired with our deep understanding of the business to test hypotheses and generate a model of the unobserved factors that comprise the client’s holistic brand. After a few iterations and brainstorming sessions, we landed on a model with three factors, turning over a dozen sources into a simple three-part view:

Awareness

Are potential customers in the company’s target demographic aware of (a) the premium personal care category and (b) the brand itself?

Affinity

Do those customers who have experienced the brand, whether as a buyer or a simple observer, view the brand and its products favorably?

Salience

When potential customers are talking about the premium personal care industry, are they talking about our client’s brand or their competitors?

Reviewing brand factor history and tying it to sales trend

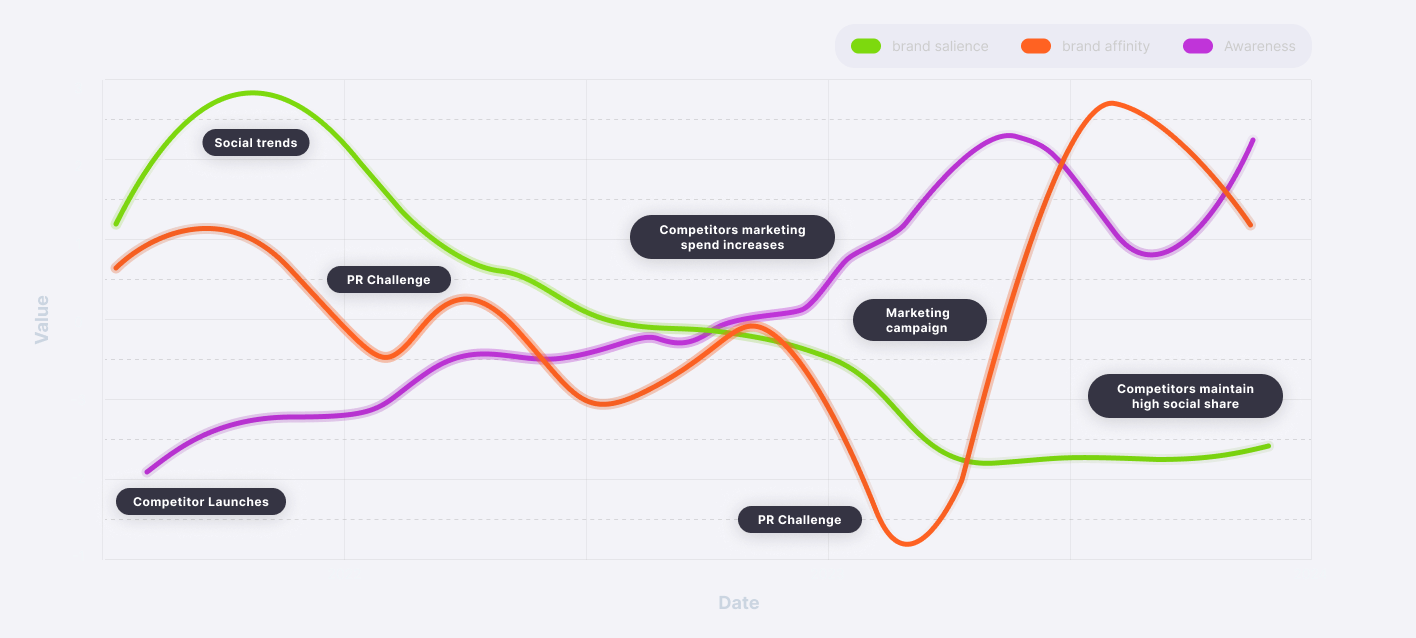

Armed with the three-factor brand model, we plotted each over multiple years and pointed to specific moments in company history, noting the effect on each factor. PR struggles, competitor investments and marketing campaigns all had predictable impacts on Awareness, Affinity and Salience, though the impacts were far from uniform:

The company was in a growing category with lots of social “buzz.” As an incumbent, increases in category awareness translated into brand awareness, so we saw an ever-increasing Awareness factor.

Our Affinity factor moved up and down in line with PR moments (good and bad) and paid media spend. It was clear that a recent campaign had helped Affinity to rebound.

The client’s Achilles heel was the Salience factor. Metrics like share of voice and search volume all pointed towards competitors continuing to build audience momentum at the company’s expense.

Gearing up for a sales turnaround

Critically, the company’s Salience factor appeared closely intertwined with the company’s sales trend, after controlling for seasonality and promotions. In a fast-changing industry like premium personal care, our brand factor model helped to reveal that staying top of mind translates directly into financial success for our client, but a recovery was necessary. Armed with the learning that a recovery in Salience would most likely result in a sales turnaround, the company shifted much of its planned Awareness media budget into deeper partnerships with targeted influencers and tastemakers to stay top of mind and best in buzz.